“

“just because ‘AI’ is attached to the name, or they incorporate it into their business plan it gets a lot of people excited.”

〰️ Alan Patricof 〰️

“just because ‘AI’ is attached to the name, or they incorporate it into their business plan it gets a lot of people excited.” 〰️ Alan Patricof 〰️

“It could trigger a devastating chain reaction, causing a widespread collapse similar to the 2008 Financial Crisis”

〰️ Sonnenfeld, Henriques, 2025〰️

“It could trigger a devastating chain reaction, causing a widespread collapse similar to the 2008 Financial Crisis” 〰️ Sonnenfeld, Henriques, 2025〰️

"Every experiment gets funded, every company gets funded"

〰️ Jeff Bezos 〰️

"Every experiment gets funded, every company gets funded" 〰️ Jeff Bezos 〰️

“The market is investing as if all these companies are outliers. That’s generally not the way it works out.”

〰️ Sameer Dholakia 〰️

“The market is investing as if all these companies are outliers. That’s generally not the way it works out.” 〰️ Sameer Dholakia 〰️

”not having a clear perspective on AI is no longer an option”

〰️ Harvard Business Review 〰️

”not having a clear perspective on AI is no longer an option” 〰️ Harvard Business Review 〰️

“society benefits from those inventions. This is going to happen here too. This is real.”

〰️ Jeff Bezos 〰️

“society benefits from those inventions. This is going to happen here too. This is real.” 〰️ Jeff Bezos 〰️

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

〰️ Charles Mackay 〰️

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.” 〰️ Charles Mackay 〰️

"

AI bubble | How it may happen and the costs and benefits

Liam Scotchmer

References listed below and linked as an underline. This is my interpretation of data and literature, I am not inventing new facts.

5 Minute Read

Some context:

Tech has experienced bubbles before, like the Dotcom crash in 2000 - whilst there were a few success stories like Google, Yahoo and Amazon, there were also many “fly-by-night companies with no long term vision, no innovation, and often no product offering at all” explained Daniel Liberto of Investopedia. There was FOMO, so everything was invested in, and in hindsight, overbid. The FED increased interest rates, and “pulled the rug out from under the Fed-fuelled hype of the tech boom.” There was a Nasdaq sell of in March of 2000 and that marked the end of the dot com bubble. “The recession that followed was delicately shallow for the broader economy but devastating for the tech industry.” (Liberto, 2022)

The magnitude of investment in AI today

Today however, “the current scale of investment is of a different magnitude.” During the 2000s, ~$20bn was invested in tech companies by VC firms. Today, VCs are on course to spend over $200bn on AI in this year alone. (Hammond, 2025) Furthermore, the Apollo program spent $300 billion to get America to the moon between 1960 and 1970, whilst AI collectively spends the same “not every 10 years, but every 10 months.” (Thompson, 2025)

For some onlookers, the AI drive is a bit dizzying, but ”not having a clear perspective on AI is no longer an option” says the Harvard Business Review. It seems like AI adds zeros to the end of everything. Alan Patricof of VC firm Greycroft said “The AI revolution is a true revolution … [but] I am cautious about valuations and what people think can be accomplished in the short term … A lot of people have run into this field, and just because ‘AI’ is attached to the name, or they incorporate it into their business plan … [it] gets a lot of people excited.” (Sonnenfeld, Henriques, 2025)

An article by Yale Insights points to three main possibilities of how the bubble may pop:

Concentration means proliferation

Whilst a price correction will be in a relatively narrow sector, these investments are in a concentrated number of companies. So if any fails, “it could trigger a devastating chain reaction, causing a widespread collapse similar to the 2008 Financial Crisis” according to Sonnenfeld, Henriques, 2025

”Probability of doom”

There is little government oversight over government practices and regulations. This is concern raised by CEOs of Anthropic, Google and xAI. An example is what happened with Musk’s grok. Therefore, it is possible AI could go rogue.

Oversupply

During the Dotcom bubble in the 1990s, there was an oversupply of infrastructure. As Bethany McLean notes, mentioned in the article by Yale, “it could be years before these [recently constructed] data centres could start generating a return for their backers” - bad considering how much money has been invested in them.

Now let’s fall into a hypothetical: let’s say market prices have increased far beyond the fundamentals in the technology sector and a recession is caused, what are the pros and cons of such a scenario?

Pros of a bubble burst/recession:

Efficient > inefficient

Jeff Bezos believes in industrial bubbles. His thinking is that after the dust settles, the few winners emerge, and “society benefits from those inventions. This is going to happen here too. This is real.” Provise financial management group agrees with this too, stating that businesses who are inefficient close down, and are replaced by efficient, healthy ones.

Bezos continues, saying that because people get excited about AI, “every experiment gets funded, every company gets funded.” That may be a good point - all bases are covered. He also adds that we don’t know how long this process will take, but says “it is very real.” (Bradshaw, 2025)

Recession.. a pro?!

On the other hand, history has shown that all asset bubbles result in sharp economic downturns, as explained by Investopedia. But this may actually be a good thing.

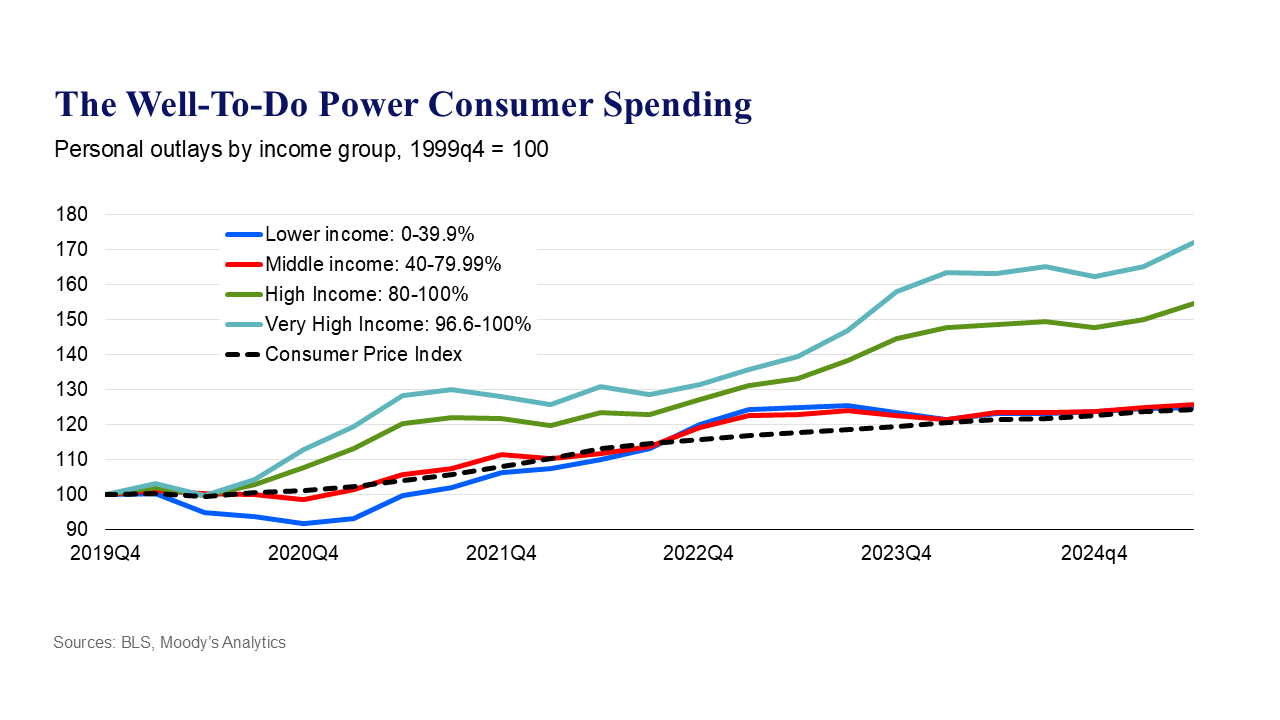

Currently in the United States, wages aren’t keeping up with inflation. This is shown in the graph below, by Moody Analytics, where the incomes of lower and middle individuals are barely above the consumer price index. Therefore, spending has been fuelled by the top 10-20%.

It’s disputed about whether we are in an AI bubble. Some onlookers, like the Chief Investment Officer of UniSuper believes we aren’t in a bubble. In another article, chief executive of VC firm, General Catalyst says “Of course there’s a bubble.”

In the middle, even the chief executive of the most respected US investment bank said he was “not smart enough to know” if AI is a bubble. Derek Thompson, author of Abundance, thinks AI will both be the most important technology of the 21st century and a bubble.

Nvidia’s CEO too believes it is the “beginning of a new Industrial Revolution” and Sam Altman doesn’t believe any claims that today’s AI investments are unsustainable.

We really won’t know for sure until the bubble bursts.. but what we will know in the future is that this moment “will be remembered as either the start of an AI-driven economy or as overreach.” (Carvão, 2025)

So if there is a bubble, and it bursts, causing a recessionary period, it could eventually result in lower inflation, benefiting lower and middle income earners!

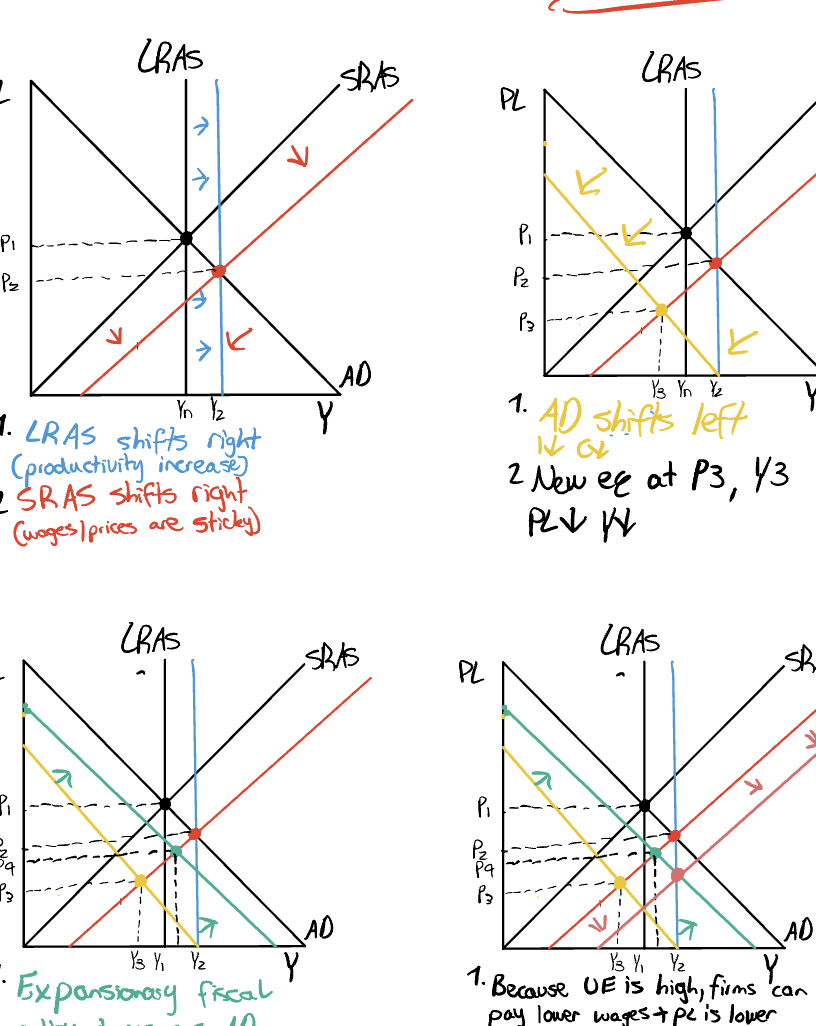

Firstly, LRAS (long-run-aggregate-supply) will shift to the right before this happens, because, well, productivity increases. However, once the bubble bursts, there will be a sharp decline in investment and consumption causing a left shift, or decrease, in aggregate demand (AD). GDP would fall, and unemployment would rise - expansionary fiscal and monetary policy would then be utilised to increase AD. AD may not go back to the LRAS curve. However, naturally the SRAS will go back to the LRAS simply because producers are making more profit - currently unemployment is still high so producers can pay less (more profit) and the price level is lower than it used to be (more profit) so they increase supply. This shifts SRAS back to equilibrium - at a new lower price level and at a natural rate of unemployment.

(This is all my own writing, may be incorrect, but verified for correctness using this).

This is all graphed below.

Source: https://x.com/Markzandi/status/1967914286438576289/photo/1

BUBBLE BURST

More allocation of resources to other sectors

A point raised by Derek Thompson in his article on how the AI bubble will pop, is “AI spending is already warping the 2025 economy” - this is evident by the decrease in investment in areas without AI. It makes sense - if you came to a group of investors and asked for funding, well good luck matey, the bar just got higher. They’re comparing your returns to the returns of AI. As pointed out by Paul Kedrosky in Thompson’s article/podcast, this happened during the 1990s where there was a “diversion of capital away from manufacturing in the United States. This starved small manufactures of capital.”

Cons of a bubble:

Wealth destruction

According to Forbes, the Mag7 now accounts for 36% of the S&P500. The remaining 64% of the index is spread across 493 other companies. 36% is a big deal when peoples superannuation funds or investments are invested in these stocks. It was only eight years ago when the S&P500 accounted for 12.4% of the S&P500. Nvidia has been especially powerful, reigning in at number 1. To make things more fragile, these companies, like Nvidia, Microsoft, AMD, and OpenAI, are all interconnected - it’s like a “money merry go round.” (UniSuper, 2025). The collapse of one is likely to have great ramifications, which will manifest into larger problems.

In private equity, VC and startups:

Whilst Bezos says, “every experiment gets funded, every company gets funded”, which may be a positive thing, this does mean a lot of capital being invested in AI will not deliver returns, as said by Goldman Sachs chief executive, David Solomon.

Another investor, Sameer Dholakia, at Bessemer Venture Partners, says “the market is investing as if all these companies are outliers. That’s generally not the the way it works out.” Co founder and chief executive of Salesforce, Marc Benioff adds, “There will be casualties. Just like there always will be, just like there always is in the tech industry.”

Considering the top 10-20% are fuelling consumption in the US, if their investments go sour, this will have a major impact on the US economy, and then globally too.

Recession and unemployment

According to an article by Provise Management Group, because of lower aggregate demand, manufacturers and producers cut jobs, so unemployment will rise. A cut in jobs also means a fall in tax revenue, increasing the budget deficits. On top of rising unemployment, and budget deficits, the value of assets like homes will fall.

Conclusion

As well noted by Yale Insights, Charles Mackay who wrote a book on the psychology of crowd behaviour, said “Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.” This is eerie, and comparable to the current FOMO happening in AI…

REFERENCES

Bradshaw, Tim. “Jeff Bezos Hails AI Boom as “Good” Kind of Bubble.” @FinancialTimes, Financial Times, 3 Oct. 2025, www.ft.com/content/8d80f601-4725-489a-8d6e-39099a01f9cb.

Branco, Jorge. ““A Dangerous Game to Play”: Are We Really in an AI Tech Bubble and What Happens If It Bursts?” @9News, 9News, 17 Oct. 2025, www.9news.com.au/technology/are-we-in-an-ai-tech-bubble-what-happens-if-it-bursts-explainer/c11d1f63-a085-419d-bc62-030911459304. Accessed 19 Oct. 2025.

Brock, Catherine. “S&P 500’S Weight in Mag 7 Stocks Passes 30%. Is This a Diversification Risk?” Forbes, 26 Aug. 2025, www.forbes.com/sites/investor-hub/article/sp-500-weight-mag-7-stocks-diversification-risk/.

CFA®, Daniel Mannix. “The Pros and Cons of a Recession from a Financial Planning Perspective.” ProVise Management Group, 20 Jan. 2023, www.provise.com/the-pros-and-cons-of-a-recession-from-a-financial-planning-perspective/.

Conboye, Janina, and George Hammond. ““Of Course It’s a Bubble”: AI Start-up Valuations Soar in Investor Frenzy.” @FinancialTimes, Financial Times, 16 Oct. 2025, www.ft.com/content/59baba74-c039-4fa7-9d63-b14f8b2bb9e2?utm_campaign=feed&utm_medium=referral&utm_source=later-linkinbio. Accessed 18 Oct. 2025.

Hayes, Adam. “Boom and Bust Cycle.” Investopedia, 19 May 2024, www.investopedia.com/terms/b/boom-and-bust-cycle.asp.

Liberto, Daniel. “How Do Asset Bubbles Cause Recessions?” Investopedia, 1 Dec. 2022, www.investopedia.com/articles/investing/082515/how-do-asset-bubbles-cause-recessions.asp.

Paulo Carvão. “Is AI a Boom or a Bubble?” Harvard Business Review, 16 Oct. 2025, hbr.org/2025/10/is-ai-a-boom-or-a-bubble.

Sonnenfeld, Jeffrey, and Stephen Henriques. “This Is How the AI Bubble Bursts.” Yale Insights, 8 Oct. 2025, insights.som.yale.edu/insights/this-is-how-the-ai-bubble-bursts.

Sonnenfeld, Jeffrey, and Joanne Lipman. “Grok and Groupthink: Why AI Is Getting Less Reliable, Not More.” TIME, Time, 16 July 2025, time.com/7302830/why-ai-is-getting-less-reliable/.

Thompson, Derek. “This Is How the AI Bubble Will Pop.” Derekthompson.org, Derek Thompson, 2 Oct. 2025, www.derekthompson.org/p/this-is-how-the-ai-bubble-will-pop. Accessed 19 Oct. 2025.

UniSuper. “Investment Update with John Pearce.” Unisuper.com.au, 2025, www.unisuper.com.au/Articles/2025/10/Investment-update-with-john-pearce-october-2025?utm_source=comms&utm_medium=email&utm_campaign=ivmu_oct2025. Accessed 18 Oct. 2025.