Fixed Rate Bonds: Basics, Bond issuing, Pricing, Current Yield, & more

Liam Scotchmer

References listed below.

8 Minute Read

Intro

The bond market is incredibly large. According to Intuition.com (O’Donnellan, 2022), the bond market is about double the size of the equity markets. This figure is astonishing, but what even is a bond?

Put simply:

A bond is similar to a loan, however the lender/borrower situation is the opposite:

you can be the lender (a bond holder) and purchase a bond, giving money to the borrower like the government or a firm. In return, you will receive a fixed coupon rate (return rate) and the principal back at maturity.

Additionally, bondholders can trade bonds between other bond investors in the secondary market.

This blog was written using a combination of articles written individually by James Chen, Nick Lioudis, Jon Fernando and Claire Boyle-White, Nielsen B and Murphy all from Investopedia (different dates), EconplusDal (YouTube, 2017), (O’Donnellan 2022), an article from the Reserve Bank of Australia (2022), one from HKT Consultants (2021) and an article by Analyst Notes (2025).

GLOSSARY refer back to this throughout the article.

According to EconPlusDal (“Bonds and Bond Yields,” 2017) a fixed rate bond has four important components:

Coupon rate - is the fixed rate of interest it pays semiannually/annually relative to face value set at issuance

Current yield: return relative to market price

Maturity - how long until the bondholder receives their full principal back (Fernando 2022)

Nominal/face/par/principal value - fixed by the issuer. It is the amount the issuer borrows, and the amount the bondholder receives at maturity. (O’Donnellan 2022)

Market price - this is what matters a lot- this is what is paid for the bond in the primary & secondary markets.

But how does the trade of bonds work? Let’s start from the beginning.

Government/firm issues a bond (government bond, municipal bond, corporate bond) with a coupon rate (the return rate) close to the market interest rate - this will either be at face value (equal to the amount the issuer borrowed), at a premium, or at a discount (this will make sense soon).

NOW INTRODUCING THE PRIMARY MARKET

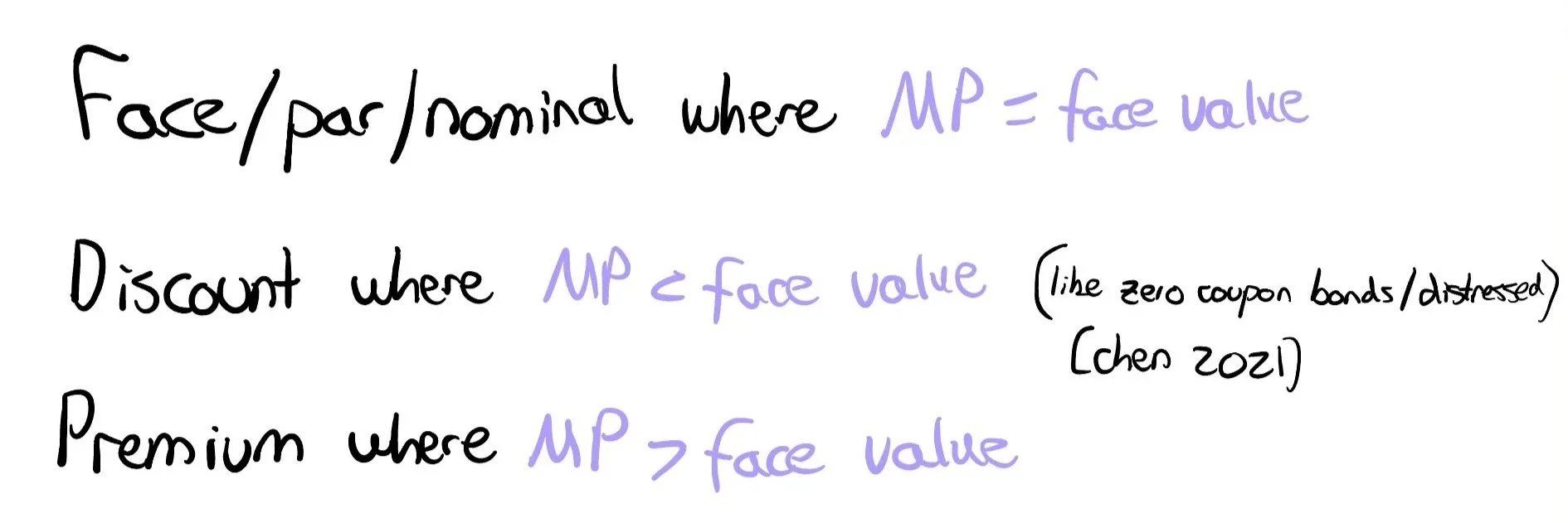

When a firm or government has first issued a bond and a bondholder buys at issuance, this is called buying in the primary market. RBA (2022)In the primary market, according to Chen (2025) the bondholder pays the market price. The market price (remember: is set by the issuer) is either at par, discount or premium compared to the face value.

PREMIUM/PAR/DISCOUNT GRAPH

Now we understand that the first issue price of a bond can be set at a discount/par/premium by the issuer.

4. INTRODUCING THE SECONDARY MARKET

If the bondholder would like to sell their bond before maturity, this will be completed in the secondary market.

Continuing on with Analyst Notes’ article (2025), the value changes as it moves closer to maturity as you can see in this graph… eventually meeting back at face value - because the face value is what is owed by the issuer at maturity, and NOT the market price!

!!!

Primary Market: Bond prices are set close to face/par value but sometimes at a discount or premium.

Secondary market: the forces of supply and demand will determine whether the bond will trade at par/discount/premium.

It is important to remember that if a bondholder buys a bond at its issuance and holds it until maturity, they will receive the face value back. However, that same bondholder can receive a different amount if they sell it before maturity in the secondary market. (US SECURITIES AND EXCHANGE COMISSION, n.d.)

5. CURRENT YIELD FORMULA

Because the coupon rate determines the return relative to face value, it is not a good determiner of return when the bond sells at a discount or premium - ESPECIALLY in the secondary market. Therefore, we can use the current yield formula which determines the return relative to market price

So the most common/easy way to calculate the yield (rate of return) is:

Current yield = annual coupon payment / market price x 100 = % rate of return

(Whilst this formula does have its flaws, it’s the simplest way to calculate it).

Calculating CURRENT Yield: EXAMPLE

“A 1-year, annual-pay bond has a $1,000 face (nominal) value and a 10% coupon (return).

Market price = 950”

Current yield: annual coupon payment / market price x 100 = % rate of return

= 100 / 950 x 100 = 10.52% RETURN (that’s a lot)

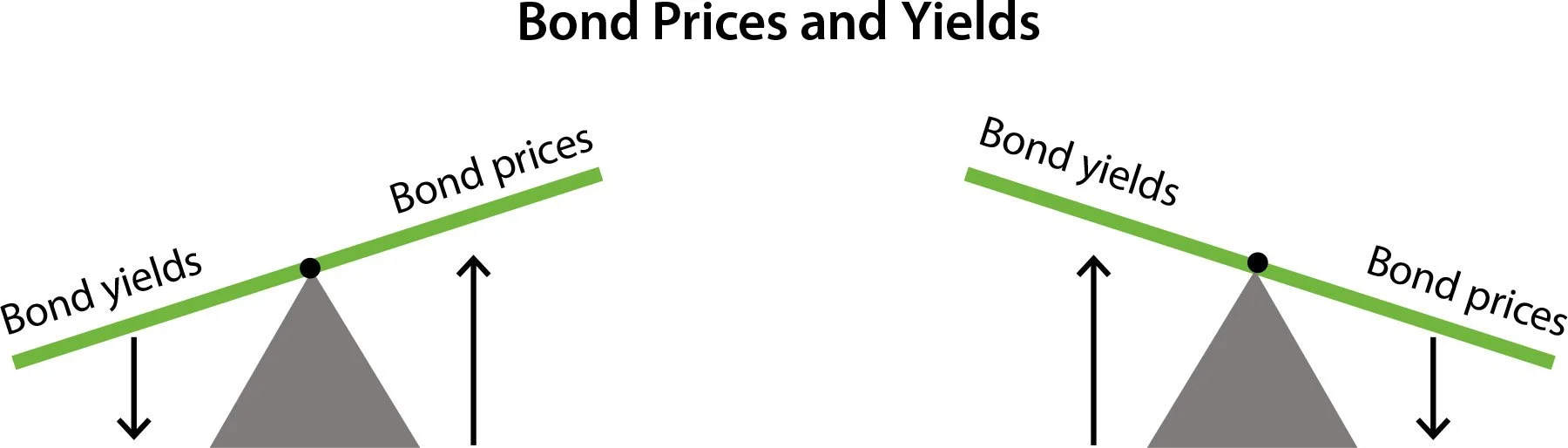

NEXT: THE INVERSE RELATIONSHIP BETWEEN BOND YIELDS AND BOND MARKET PRICES

Now that we understand that bond market prices prices can sell at par, at a discount, or at a premium, it is important to understand the inverse relationship between market prices and yields.

Fundamentally:

When bond prices rise, yields (returns) decrease: this is because annual coupon payment is divided by market price

When bond prices fall, yields (returns) increase this is because annual coupon payment is divided by market price

FIXED RATE BOND TRADING AT PREMIUM, PAR, DISCOUNT DUE TO MARKET INTEREST RATE, CETERIS PARIBUS: EXAMPLE

“A 1-year, semi-annual-pay bond has a $1,000 face (nominal) value and a 10% coupon (return).”

*Market price change in each example

- “At a market rate of 8%, the bonds price is $1,019 (premium)”

(Bond is selling at a premium because the coupon rate (10%) > market rate (8%). Therefore, there are many buyers wanting this bond & are pushing up the price. The current yield (return) is 9.81% (smaller return than discount and par because this bond costs more to buy.. makes sense, right?)

- “At a market rate of 10%, the bonds price is $1,000 (price here = face value)”

(Bond value is equal to face value because coupon rate = market rate. And current yield is 10% because at par, face value = coupon rate)

- “At a market rate of 12%, the bonds price is $982 (discount)”

(Bond is selling at a discount because coupon rate < market rate. There are few buyers wanting to buy this bond. And current yield is 10.18%, that’s higher than premium and par because bond was bought cheaply, so more earnings.. makes sense).

5. COMBINING CURRENT YIELD + PREMIUM/PAR/DISCOUNT

REMEMBER:

Coupon rate is the fixed rate of interest it pays annually relative to face value set at issuance

Current yield is the rate of return it generates relative to market price (it fluctuates!!!!) (Boyte White, 2024)

The key idea is that the coupon rate is fixed, but yield changes depending on whether the bond trades at a premium, par or discount.

In the example below, you can see that the coupon rate remains at 10% in every example, however the yield differs.

Therefore, remember: the yield is very important, especially in the secondary market.

An example of this from Analysts.com 2025:

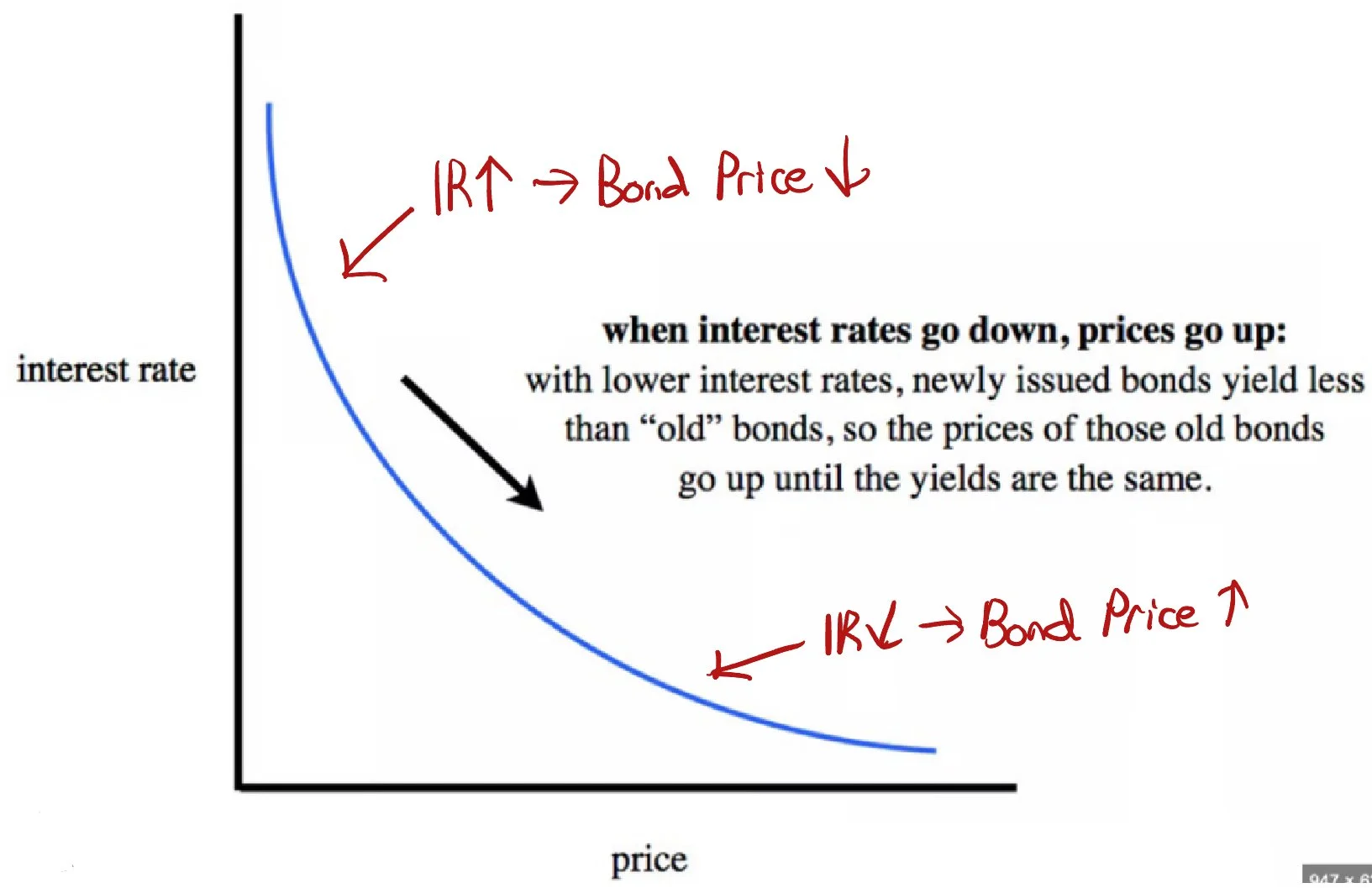

5. INVERSE RELATIONSHIP BETWEEN BOND PRICES AND MARKET INTEREST RATES

There is an inverse relationship between bond prices and market interest rates for both old and new bonds.

Using an example of an existing (old) bond:

-> you buy bond from company ABC at 5% coupon rate

-> 1 year later, market rates have lowered, so ABC must offer the same bond at same face value, but at 4% coupon rate (less)

-> this affects the value of your “old” bond: your bond will now be worth more because buyers prefer your “old” bond (higher demand)

-> the price of your bond will keep going up until the yield of your bond matches market interest rates

Using an example of a new bond:

-> Market rates have lowered, So ABC must issue their bonds at lower coupon rate (simple) to align with market rates (other factors can affect this though)

Coupon rate (return) on bond > market interest rate = more demand for the bond = higher bond price = lower yield. This happens until the higher bond yield closely aligns market interest rates.

Coupon rate (return) on bond < market interest rate = less demand for bonds = lower bond price = higher yield. This happens until the lower yield closely aligns the higher market interest rates.

Nevertheless, the bond value will always equal the face value eventually, at it reaches maturity, since that is what the issuer owes. (EconplusDal, 2017)

This is shown below.

This inverse relationship between bond prices and market interest rates as shown below:

Lower interest rate: when the interest rate lowers, the price of bonds increases (more demand) and its yield decreases until yields match market interest rates

Higher interest rate: when the interest rate increases, the price of bonds decreases (less demand) and its yield increases until yields match market interest rates

IMPORTANT CAVEATS:

Risks of owning a fixed rate bond

As we have just seen, because there is an inverse relationship between market interest rates and bond prices, there is risk involved. One risk that is apparent is when market interest rates increase “making an investor’s existing bond less valuable'.” (Chen 2021). If this is confusing, here’s some examples, with the help of Investopedia (Chen 2021).

For example,

-> bondholder buys a bond that pays a fixed annual interest rate (coupon rate) of 5%,

-> but the market interest rate increases to 7%

two things happen:

1) the price of their bond decreases, so if they decide to sell it may be at a loss

2) they will miss out on the higher interest rate

Inversely,

-> bondholder buys a bond that pays a fixed annual interest rate (coupon rate) of 5%,

-> but the market interest rate decreases to 3%

two things happen:

1) the price of their bond will increase, so if they decide to sell it will be at a gain

2) they will have a higher interest rate than others! Yay!

(Chen 2021)

- FINAL: OTHER CONSIDERATIONS

Continuing on with Investopedia’s article (Chen 2021):

1) shorter bond terms for fixed rate bonds are less risky* (Chen 2024)

*However, they will earn a lower interest rate than longer term fixed rate bonds

2) If the bondholder does decide to not sell before maturity, they “will not be concerned about possible fluctuations in interest rates.”

3) The real interest rate = nominal - inflation, so if inflation rises over the duration of the bond term, the purchasing power will lower. (Chen 2024)

4) if investors believe a bond’s yield won’t keep up with inflation, its price will decrease (less demand for it)

5) It is better to buy bonds when interest rates are high because the companies and governments issuing them must pay a higher yield “to attract investors".”

6) Interestingly, when market rates are low, corporations “retire [old] high cost debt, and issue new bonds for longer durations to lock in the lower rate. (McKenna 2025)

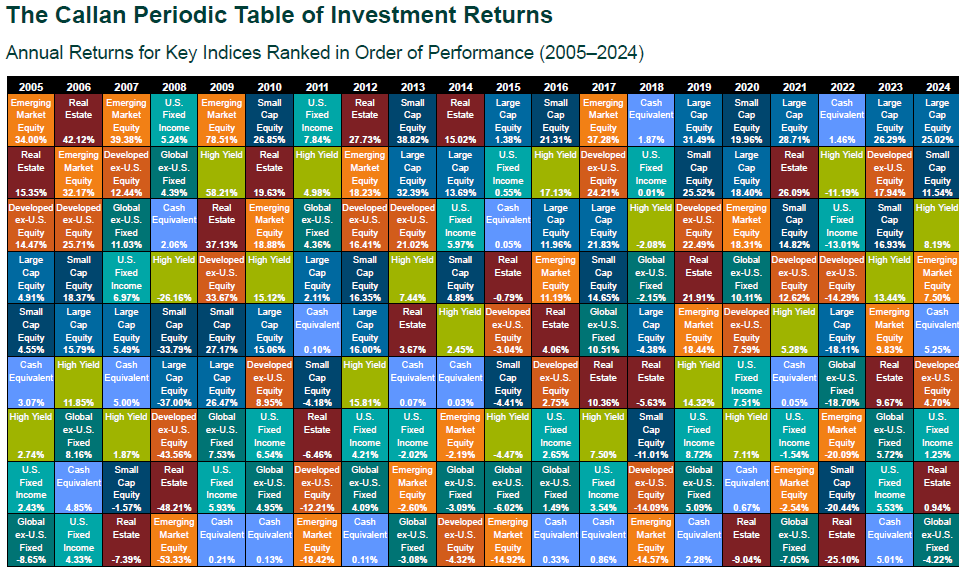

END: Diversification is paramount. Whilst bonds aren’t the top performers, they are safe. (McKenna 2025) This table shows the top performers (top) and lowest performers (bottom). The top performers fluctuate year to year.

REAL WORLD EXAMPLE

Lower market interest rates = higher demand for bonds = higher bond prices = lower yields until equilibrium

Higher market interest rates = lower demand for bonds = lower bond prices = higher yields until equilibrium

Remember, that is the main relationship between bond yields and interest rates.

This figure from HKT Consultants (2021) shows a decline of bond yields after ~around 2008.

1) Interest rates were lowered in US (and worldwide) near zero (RBA 2025)

2) Therefore, investors took to bonds and bought more, because of many reasons,: such as the higher yields on bonds than market rates and “flight to quality” from equities (Chen 2022).

3) This drove the price up for bonds which pushed the yields down on bonds. (McKenna, 2025)

REFERENCES

Fernando, Jason. “Bonds: How They Work and How to Invest.” Investopedia, 3 May 2024, www.investopedia.com/terms/b/bond.asp.

McKenna, K. (2025). Are Bonds Safe During a Recession or Market Crash? [online] Darrow Wealth Management. Available at: https://darrowwealthmanagement.com/blog/bonds-during-recession/.

Reserve Bank of Australia (2025). The Global Financial Crisis. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/education/resources/explainers/the-global-financial-crisis.html.

Nielsen, B. (2024). Understanding Bond Prices and Yields. [online] Investopedia. Available at: https://www.investopedia.com/articles/bonds/07/price_yield.asp.

Lioudis, Nick. “The Inverse Relationship between Interest Rates and Bond Prices.” Investopedia, 15 Oct. 2024, www.investopedia.com/ask/answers/why-interest-rates-have-inverse-relationship-bond-prices/.

HKT Consultant. “How Bond Prices Vary with Interest Rates – HKT Consultant.” Phantran.net, 23 June 2021, phantran.net/how-bond-prices-vary-with-interest-rates/. Accessed 27 Sept. 2025.

Chen, James. “Bond Discount.” Investopedia, 29 May 2021, www.investopedia.com/terms/b/bond-discount.asp.

EconplusDal. “Bonds and Bond Yields.” YouTube, 11 Mar. 2017, www.youtube.com/watch?v=_OwppAqFPIw. Accessed 2 Feb. 2025.

Reserve Bank of Australia. “Bonds and the Yield Curve.” Reserve Bank of Australia, 2022, www.rba.gov.au/education/resources/explainers/bonds-and-the-yield-curve.html.

Boyte-White, Claire. “Bond Yield Rate vs. Its Coupon Rate.” Investopedia, 2019, www.investopedia.com/ask/answers/051215/what-difference-between-bonds-yield-rate-and-its-coupon-rate.asp.

Chen, James. “Fixed Rate Bond Definition.” Investopedia, 31 Mar. 2021, www.investopedia.com/terms/f/fixedrate-bond.asp.

Analystnotes.com. “2025 CFA Level I Exam: CFA Study Preparation.” Analystnotes.com 2025, analystnotes.com/cfa-study-notes-relationships-between-bond-price-and-bond-characteristics.html. Accessed 27 Sept. 2025.

Ruairi O'Donnellan (2022). What is the Bond Market? - Intuition. [online] Intuition. Available at: https://www.intuition.com/what-is-the-bond-market/ [Accessed 28 Sep. 2025].

Chen, J. (2021). Factors that Create Discount Bonds. [online] Investopedia. Available at: https://www.investopedia.com/terms/d/discountbond.asp.

Murphy, C.B. (2020). How a Premium Bond Works and Why They Cost More. [online] Investopedia. Available at: https://www.investopedia.com/terms/p/premiumbond.asp.

US SECURITIES AND EXCHANGE COMISSION (n.d.). Bonds, Selling Before Maturity | Investor.gov. [online] www.investor.gov. Available at: https://www.investor.gov/introduction-investing/investing-basics/glossary/bonds-selling-maturity.

Chen, J. (2022). Flight to Quality Definition. [online] Investopedia. Available at: https://www.investopedia.com/terms/f/flighttoquality.asp.

Full disclosure: I used advice from Reddit users on an Economics forum, and ChatGPT to fact check. Information may be wrong so do not use this as investment advice!