China’s auto industry price war

Liam Scotchmer

References listed below.

4 Minute Read

Summary

Automakers in china - specifically EV makers are very competitive. They are all trying to undercut each other. This is trimming their profits. In addition to this, they are supplying more and more, leading to oversupply. This is a phenomenon called “involution” which means excessive and “self defeating” behaviour - to the point where there’s diminishing returns (Lo, 2025). Sounds like the Chinese EV industry.. right? Whilst this competitive behaviour isn’t unique to China or the car industry, today’s topic will be on this price war.

Whilst these subsidies are not unique to China of course- China's car manufacturers have had a lot of success with them . A quote from an article by The Economist (A, 2024) says, "It is hard to be precise about the value of the underpriced loans, equity injections (cash contributions), subsidies and government contracts Chinese firms enjoy." But as The Economist (A, 2024) says, "If China wants to spend taxpayers’ money subsidising global consumers and speeding up the energy transition, the best response is to welcome it!"

It therefore comes at no surprise that during Germany's big car show in Munich a few weeks ago, the Chinese automakers including BYD and Xpeng presented electric vehicles (EVs) that completely undercut (in price) established European automakers, whilst still displaying an array of fancy technology. (The Economist, B, 2025)

However, under the bonnet, a price war in the auto industry has emerged in China's economy.

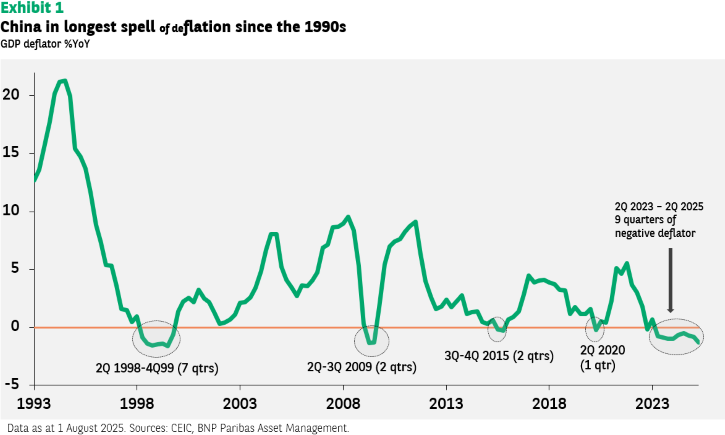

For Chinese automakers, it has been a race to the bottom on pricing for cars, profits have been eroded, and there is overproduction. This is adding deflationary pressure onto the Chinese economy which has been going for 9 consecutive quarters. This “excessive, [competition pattern] and self-defeating competition among Chinese companies” is known as involution by Economists. (Lo, 2025)

Chi Lo, Senior Market Strategist for BNPP AM explains it simply, "if you have it, I must have it too, and cheaper." Furthermore, Chi adds "the market has, arguably failed as a mechanism for balancing supply and demand because suppliers focus on competitors' moves rather than on market needs."

According to The Economist (B, 2025) about 130 car manufacturers are competing in China. Stella Li - a senior executive of BYD said on The Economist (B, 2025) "there are too many carmakers, close to 100 need to be pushed out and even if 20 remain that may be too many."

So, some Chinese automakers have turned to exports- "the number of cars shipped abroad quadrupled, taking China past Japan to become the world's largest exporter." (The Economist, B, 2025) Europe has become China's main destination for EVs, up 5.2% from 3.1% the year prior. (The Economist, B 2025)

"Pity Ford, VW, and other Western manufacturers" says The Economist (B 2025) - and pity indeed - European automakers and American brands are feeling the pinch. They can't compete with the carnage of involution

(nei-juan in Chinese).

A quote by The Economist (B, 2025)

"A continuing price war will force the best to become even leaner, more efficient and more innovative. And that means China’s most powerful firms should thrive, both at home and abroad.”

REFERENCES

The Economist B. “The Brutal Fight to Dominate Chinese Carmaking.” The Economist, 15 Sept. 2025, www.economist.com/business/2025/09/15/the-brutal-fight-to-dominate-chinese-carmaking.

The Economist C. “The Threat of Deflation Stalks Asia’s Economies.” The Economist, Sept. 2025, www.economist.com/finance-and-economics/2025/09/01/the-threat-of-deflation-stalks-asias-economies.

Lo, Chi. “China – Involution, Deflation and Structural Reform – EN.” ViewPoint English, 11 Aug. 2025, viewpoint.bnpparibas-am.com/china-involution-deflation-and-structural-reform/.

Lauder, Jo. “Are Electric Cars Really Greener than Petrol Cars? We’ve Lined up Two SUVs and Put Them to the Test.” ABC News, 27 May 2024, www.abc.net.au/news/2024-05-27/comparing-electric-cars-and-petrol-cars/103746132.

The Economist A. “An Influx of Chinese Cars Is Terrifying the West.” The Economist, 11 Jan. 2024, www.economist.com/leaders/2024/01/11/an-influx-of-chinese-cars-is-terrifying-the-west.

Equity Mates. “Equity Mates on Instagram: "America vs China - Who Wins in These Important Emerging Technologies?” Instagram, 2022, www.instagram.com/reel/DOskEJEE_sI/?igsh=MWhieGdwOWo5MzVxaA==. Accessed 25 Sept. 2025.

"It's origins lie in the Chinese government's success in first nurturing its carmakers and then propelling them to the fore of the global industry" (The Economist B 2025) But as you'll see next, this "nurturing" has turned into overproduction and price wars.

This "nurturing" is best explained by Equity Mates (2025) on their podcast, where they mention China's emerging model of capitalism - which goes as follows: when the government wants something, it pours massive amounts of government spending into a particular industry in a particular province. The government funds many startups and then leaves them to be- the startups then compete "viciously" just in China - and there arrives winners. What emerges is an efficient supply chain across provinces. "[These industries are] artificially created." Equity Mates (2025) They then compete globally. This is the opposite to other countries where private capital is required to start a business.