3 Reasons Why the Price of Bond ETFs Fluctuates

Liam Scotchmer

References listed below.

7 Minute Read

Individual bonds and bond ETFs are similar, but a bond ETF like the iShares U.S. Treasury Bond, called GOVT, has many more upsides.

Firstly, purchasing an individual bond is quite a tedious and difficult task, so bond ETFs fix this issue by trading on major indexes like the NYSE. Additionally, bond ETFs typically have a lower standard deviation, higher liquidity and offer more transparency. Furthermore, because bond ETFs like GOVT are comprised of U.S. treasuries with maturity dates between 1 and 30 years, bond ETFs pay interest more regularly.

However, because a bond ETF never matures, and if say, market interest rates rise, the prices of bonds will fall, and investors principal may not be paid back in full.

Factors that affect a bond ETF

There are three main factors that affect the price of a bond ETF.

- Changes in interest rates

- Duration

- Credit quality

Changes in interest rates

There is an inverse relationship between bond prices and market interest rates for bonds. This makes sense: consumers who want a higher return look for higher returns - if the bank offers a higher interest rate than bonds do, consumers go to the banks rather than bonds.

The rule:

When interest rates rise more than coupon rate of a bond -> price of bonds fall & yields rise

When interest rates fall more than coupon rate of a bond -> price of bonds rise & yields fall

Duration

Firstly, duration is not the same as time to maturity.

Time to maturity is the amount of time until maturity.

Duration is how sensitive a bonds’ price is to interest rate changes.

Duration can be given in two ways, let’s begin with the macaulay duration.

Macaulay Duration

With the macaulay duration, according to Adam Hayes (2025) it is the weighted average time until all of the bond’s cash flows are paid. It is calculated using quite a complex formula, but we can visualise it:

Below each column is a coupon payment, the last being the largest- because it’s the principal payment. The average of these is what we call the macaulay duration.

Why does it matter?

Remember, duration is how sensitive a bonds’ price is to interest rate changes.

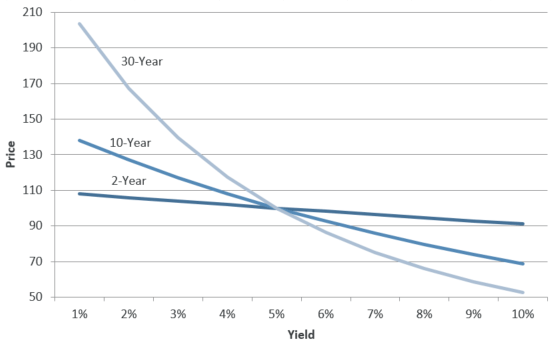

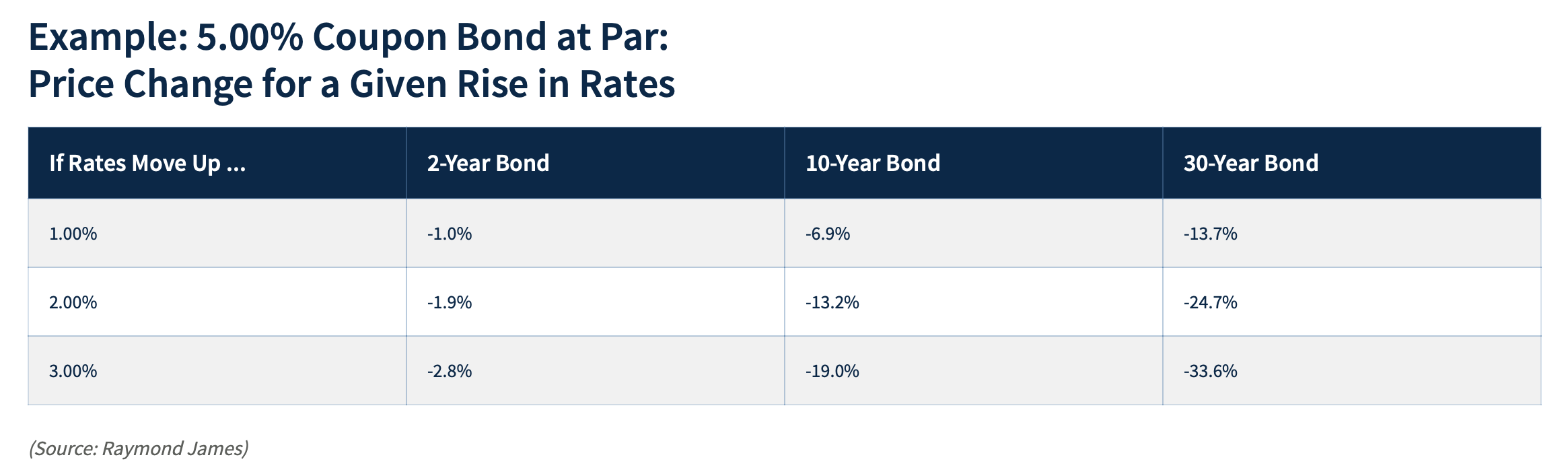

Bonds with longer durations, as seen below, are more sensitive to changes in price. You can see below that the 30 year bond responds more greatly than the others, and this is both directions: when interest rates rise and fall.

Image generated using ChatGPT

Let’s try another example and see which bond is riskier when one has a long duration and the other, a shorter duration.

Bond A

- 10 year treasury

- coupon 0%

Bond B

- 10 year treasury

- Coupon 5%

If you looked solely at time to maturity, you’d assume they both have the same risk, however if interest rates were to rise:

Bond A has a long duration because its payment is far out into the future. Its principal payment gets destroyed by both discounting AND the interest rate change. It is very sensitive to rate changes.

Bond B has a shorter duration because its payments are spread out. Its principal payment also gets destroyed by discounting. However the earlier coupon payments aren’t discounted as much. The overall effect of the interest rate change isn’t as severe.

So if interest rates were to rise, bond B is a better choice - it has a shorter duration.

In summary, a bond with a longer duration is more sensitive to changes in interest rates than those with shorter durations. So depending on the composition of a bond ETF, the ETF price will fluctuate accordingly.

Example

Modified Duration

The modified duration is much simpler- it “converts the Macaulay duration into an estimate of how much the bond’s price will rise or fall with a 1% change in yield to maturity.” (Hayes, 2025) So it does NOT give you an answer in years.

It assumes that the percentage price change is directly proportional to the change in bonds yield.

So if we continue with the example above and we follow the rule, then:

2.648 year duration -> YTM up 1% = price of bond would fall by 2.648%, and vice versa.

This is an easy assumption to make: we can easily predict how a bonds price will fluctuate due to a change in interest rates. However, and yes it gets slightly confusing, the line isn’t linear, bonds are convex. That is a topic for another day.

Example

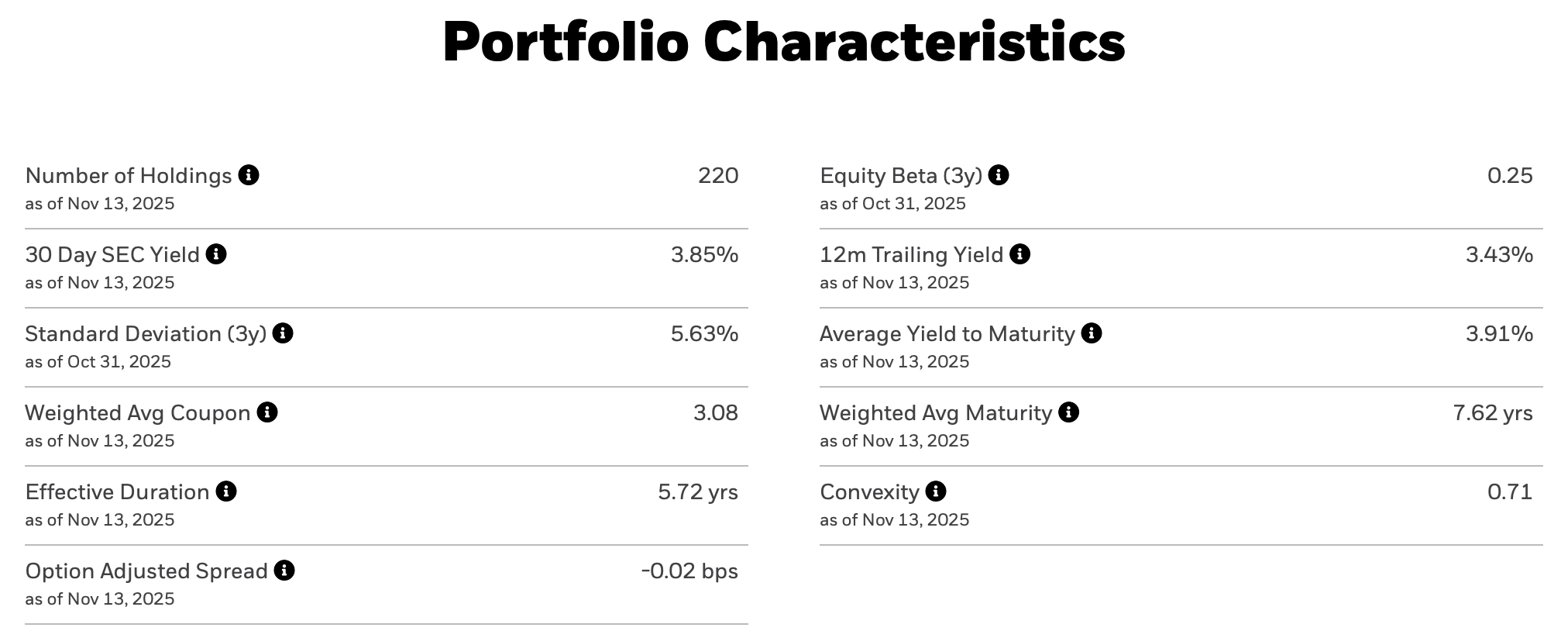

You can see in the image above for the GOVT ETF that the duration is 5.72.

The intuition is: if interest rates rise or fall by 1%, the bond ETF’s price will rise/fall by 5.72%.

Compare this to an individual bond; US7Y, a US treasury bond - ChatGPT calculated a modified duration of 6.35years, therefore if interest rates rise or fall by 1%, the bond price will rise or fall by 6.35%.

Credit quality

Credit quality is an assessment of an entity’s ability to repay their debts. They are given by independent bond rating agencies. A credit rating can be given to a whole company or to a particular issue of bonds. (Chen, 2023)

There is an inverse relationship between a bond’s rating and its yield. A higher bond rating means a higher price, and a lower bond rating means a lower price.

The ratings range from high (AAA to AA), to medium (A to BBB), and low (BB, B, CCC, CC, C, and D).

BB and lower are called non investment grade bonds, or junk bonds, or high yield bonds. There’s a larger chance the bond issuer will default, therefore, they have a higher rate of return.

D is given to bonds which are already in default.

You can check the investment grade of a bond using bond rating agencies like S&P Global, Fitch Ratings, or Moody’s Investors Services.

References

1GOV - VanEck 1-5 Year Australian Government Bond ETF . (2023). 1GOV - VanEck 1-5 Year Australian Government Bond ETF. [online] Available at: https://www.vaneck.com.au/etf/income/1gov/snapshot/.

Chen, J. (2023). Credit Quality Definition. [online] Investopedia. Available at: https://www.investopedia.com/terms/c/creditquality.asp.

Chen, J. (2024). Convexity Measures Bond Price and Bond Yield Relationships. [online] Investopedia. Available at: https://www.investopedia.com/terms/c/convexity.asp.

Fidelity (2019). Bond Ratings - Fidelity. [online] Fidelity.com. Available at: https://www.fidelity.com/learning-center/investment-products/fixed-income-bonds/bond-ratings.

FIN-Ed (2019). Bond Convexity and Duration | Convexity explained with example | FIN-Ed. [online] YouTube. Available at: https://www.youtube.com/watch?v=OQ3JDGy4hw0 [Accessed 16 Nov. 2025].

Hayes, A. (2024). Duration Definition and Its Use in Fixed Income Investing. [online] Investopedia. Available at: https://www.investopedia.com/terms/d/duration.asp.

Ift.world. (2020). Understanding Fixed-Income Risk and Return | IFT World. [online] Available at: https://ift.world/booklets/fixed-income-understanding-fixed-income-risk-and-return-part3/ [Accessed 17 Nov. 2025].

iShares (2019). iShares U.S. Treasury Bond ETF | GOVT. [online] BlackRock. Available at: https://www.ishares.com/us/products/239468/ishares-us-treasury-bond-etf.

James, R. (2017). Duration & Convexity - Fixed Income Bond Basics | Raymond James. [online] Raymondjames.com. Available at: https://www.raymondjames.com/wealth-management/advice-products-and-services/investment-solutions/fixed-income/bond-basics/duration-and-convexity.

Lioudis, N. (2022). Measuring Bond Risk With Duration and Convexity. [online] Investopedia website. Available at: https://www.investopedia.com/articles/bonds/08/duration-convexity.asp.

Vaneck.com.au. (2025). Available at: https://www.vaneck.com.au/blog/income-investing/the-basics-of-bonds/.