Steepeners and flatteners: Bonds

Liam Scotchmer

References listed below.

4 Minute Read

Intro

If you haven’t read my previous article on bond yields, here’s a quick TLDR (is that how the cool kids say it..?)

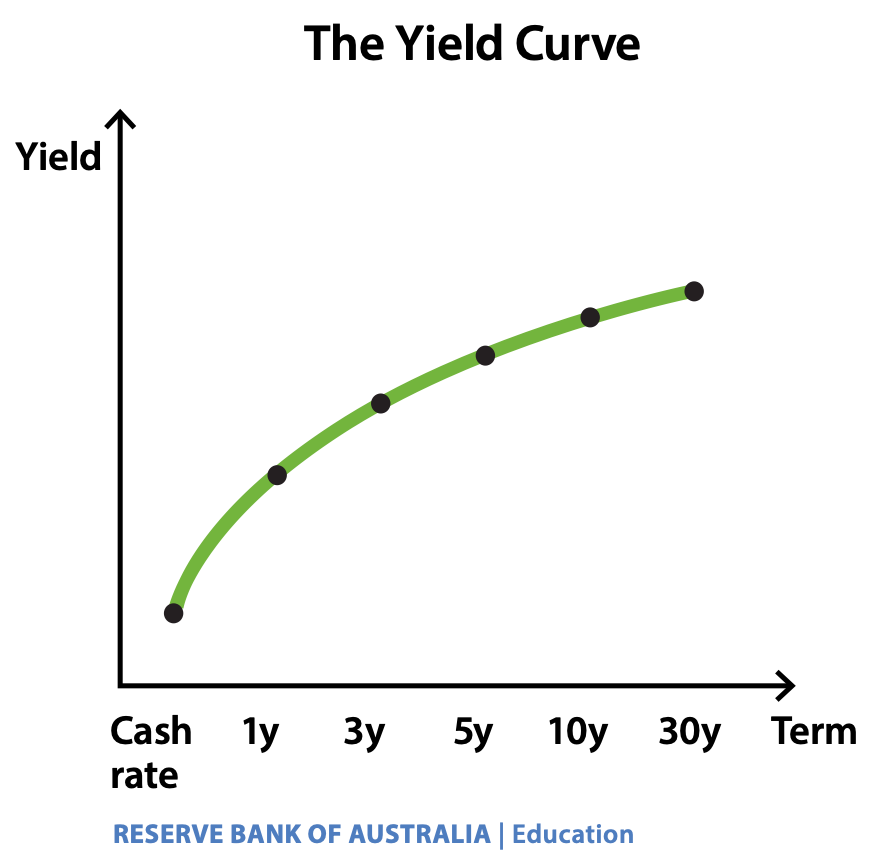

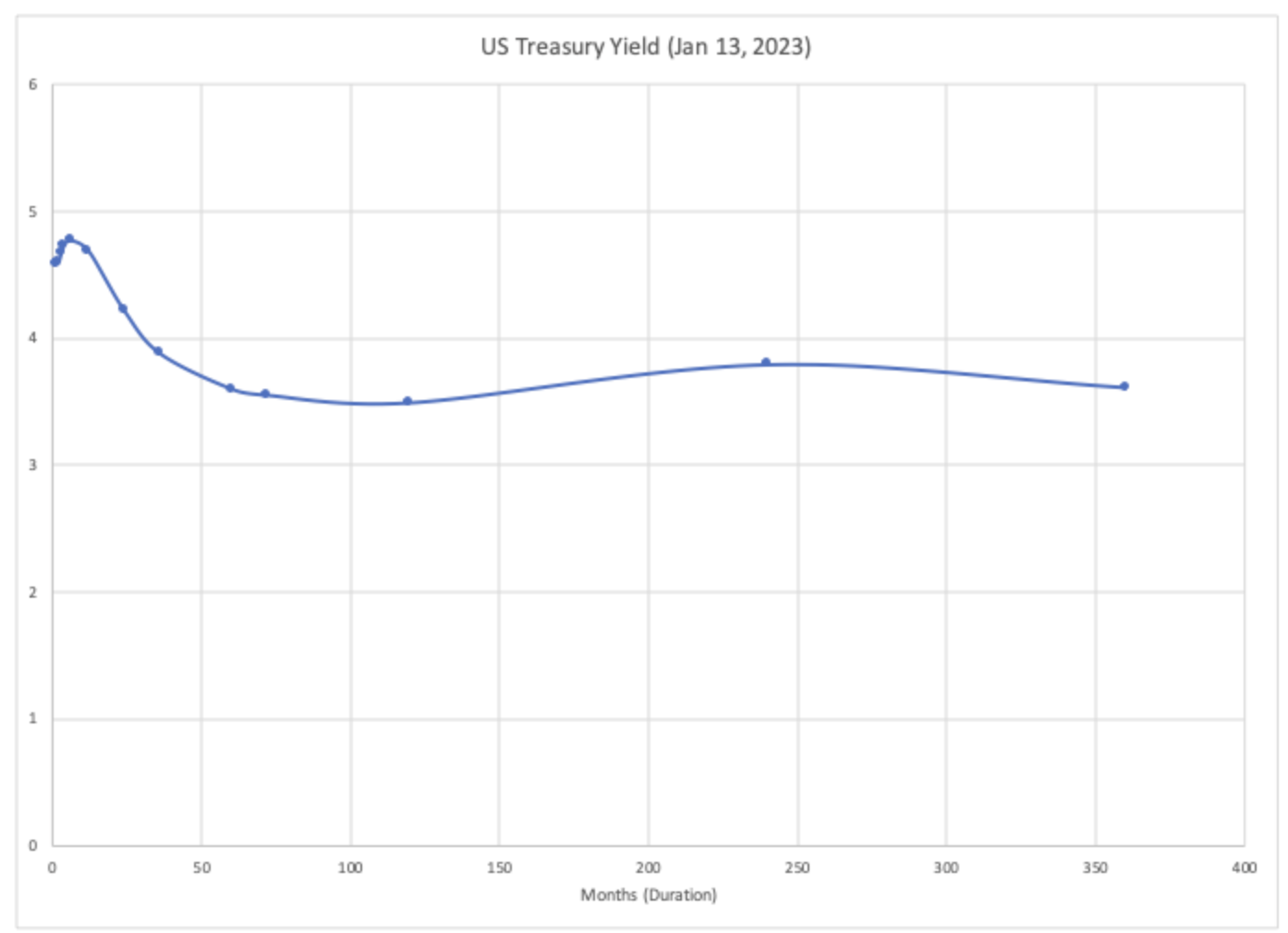

The yield curve shows the yield on bonds over different terms to maturity, or in other words, if you plot the interest rate of bonds from 0 to 30 years, you get a graph that looks like the one below. (RBA 2025) This is what a normal yield curve looks like. (Millennial revolution 2023)

A quick recap on the slope of the yield curve

Flattener - bull and bear

According to the Reserve Bank of Australia (n.d.)

The normal yield curve has a short term yield that is less than the long term yield.

A flat curve is when short term yields are similar to long term bond yields

And an inverted yield curve is where short term yields are greater than long term bond yields.

All shown below:

In addition to the above variations of yield curves, there are more: the bull flattener and bear flattener.

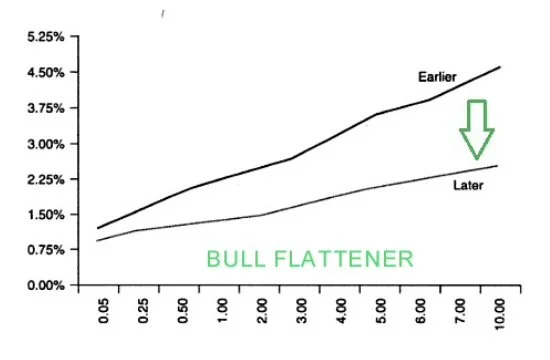

—- A bull flattener (as shown below) is “when rates on long term bonds are falling more quickly than rates on short term bonds” (bond prices up!) causing the yield curve to flatten. “Usually occurs during recessionary phases [or “flight to quality'“] when stocks, commodities, the US dollar, and the GDP are falling, while bonds are entering into a fresh uptrend.” (Patel 2021) The intuition is that “markets decrease their future inflation rate expectations”, which means -> interest rates are suspected to remain low -> demand for bonds increases now -> yields lower

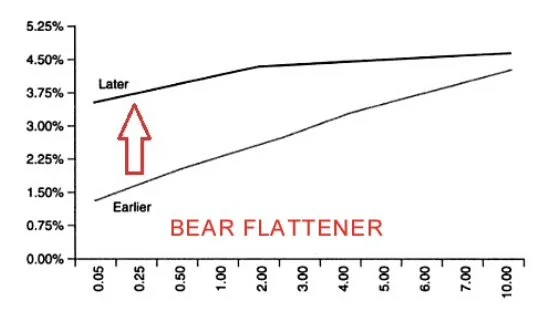

—- A bear flattener is when “short term yields are rising more quickly than long term yields” (bond prices down!) causing the yield curve to flatten. The intuition is: short term yields are high because of high policy interest rates. This formation becomes apparent during the early recessionary phase and “is an early sign of an upcoming quantitative easing cycle.” (Patel 2023).

Steepener - bull and bear

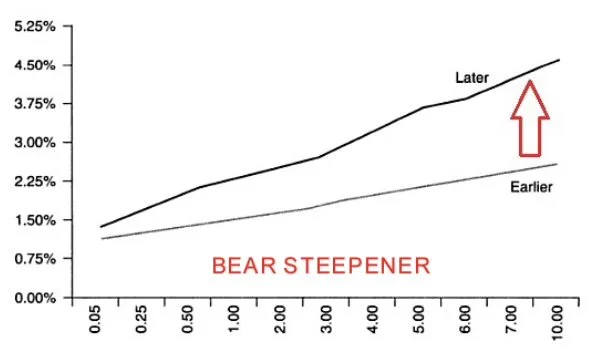

—- A bear steepener is when “yields on long term bonds rise more quickly than yields on short term bonds” causing the yield to steepen. Prices for bonds fall. The intuition is that: this occurs during the “late expansionary phase when almost all asset classes rise in value, as well as inflationary pressures” (Patel 2021) therefore investors expect interest rates to increase “reflecting investor expectations about rising inflation rates.” It is followed by tight monetary policy. (Patel 2021) (so short term bonds which are dependent on cash rate would change quickly)

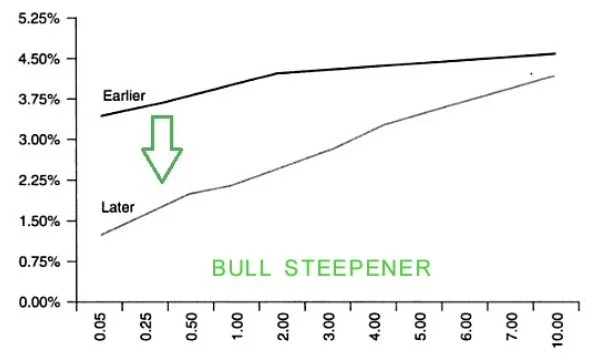

—- A bull steepener is when “interest rates on short term bonds are falling quicker than rates on long term bonds” causing the yield curve to steepen. Prices for bonds rises.

Occurs at bottom of recession phase

So just remember:

If the yield curve ends up looking steep -> steepener

If the yield curve ends up looking flat -> flattener

An inverted yield either means one of two things will happen (according to Millenial Revolution (2023):

1) A recession is incoming

2) Or bond traders think “oh the economy is going fine” and the bond curve flattens.

And bond yields have began to flatten!

The curve has started flattening as shown above or, in other words, “un-inverted”: this is called a flattening yield curve (makes sense!)

Think of it like a ladder:

-> inverted -> flattening (flattener) -> flat -> normal -> steepener

(this does not mean it always goes from inverted to steepener, yields may skip)

What happens when the yield curve begins to un-invert?

When a yield curve un-inverts, 4 things may happen:

1) Bond prices fall: Because yields and bond prices are inverse: when the yield flattens, its yield is increasing, which means bond prices are falling. This is bad for bondholders with old bonds at lower interest rates, as the value of their bonds will decrease.

2) Stock prices may fall: Because bonds look more attractive than stocks, people may flock to bonds.

3) Mortgage rates will rise, particularly in countries like the United States where interest rates on loans are based on parts of the yield curve (American mortgages are tied to the 10 year yield) (The Millennial Revolution 2023). *In Australia our loans are based on the shorter term end of the yield curve (RBA n.d.).

4) Bonds will pay better.

Hello

Reserve Bank of Australia. “Bonds and the Yield Curve.” Reserve Bank of Australia n.d.

https://www.rba.gov.au/education/resources/explainers/pdf/bonds-and-the-yield-curve.pdf?v=2025-09-30-18-30-27

https://facebook.com/millennialrevolutionblog. “A Flattening Yield Curve: What Does It Mean?” Millennial Revolution, 9 Oct. 2023, www.millennial-revolution.com/invest/a-flattening-yield-curve-what-does-it-mean/. Accessed 3 Oct. 2025.