Asymmetric Stag Hunt EXplained:

Payoff Dominance vs Risk Dominance & Unequal Payoffs

Game theory analyses situations for individuals/entities using games. A game is a situation in which decisions are interdependent, creating a shared, mutual impact and is displayed on a “matrix". The combination of each “player’s” decision results in a payout, otherwise known as utility. Typically the higher the number the higher the utility.

5 Minute Read

References quoted & linked below

Asymmetric Stag Hunt Definition

And per (“Asymmetric Games Definition - Game Theory Key Term | Fiveable”) a game is asymmetric when:

1) “players have different unequal strategies and payoffs”

2) can lead to suboptimal outcomes, “as one player may exploit their advantages while others cannot make informed decisions.”

Per (“The Stag Hunt (Game Theory) - IMotions”) a game is a stag hunt when:

1) there are two nash equilibria

2) there is a cooperative (payoff dominant) and non-cooperative (risk dominant) equilibrium

Stag Hunt Criteria

Asymmetry Criteria

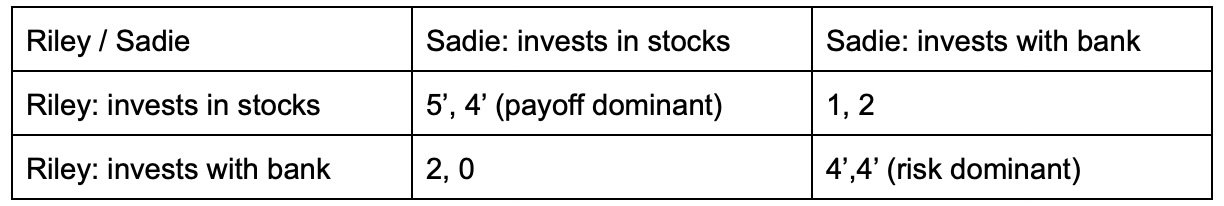

This game below is asymmetric because each player (Riley, Sadie) has a distinct set of payoffs. It is a stag hunt because If we run through the model, we will see that there are two Nash Equilibria. One is cooperative/payoff dominant, and the other is non-cooperative/risk dominant.

This Game

(stocks,stocks) is payoff dominant, yielding 5,4.

(bank, bank) is risk dominant, yielding 4,4.

The two Nash equilibria:

The matrix values are assuming the stock market has higher returns, but is riskier. This is NOT financial advice.

(5,4) Riley stocks, Sadie stocks. This asymmetric game features unequal payoffs- Riley stands to gain more from investing in stocks than Sadie. Riley is less risk averse so he feels better, so receives a satisfaction of 5. Sadie receives 4. Nevertheless, the joint benefit is high because they’re optimistic about what returns they can receive, especially with Riley’s expertise.

(4,4) Both invest their money in a deposit at the bank, both receiving 4. Lower risk outcome (which I’ll get to) but lower returns.

(2,0) Riley bank, Sadie stocks. Sadie, without Riley’s expertise on the stock market, picks an individual stock (she puts all her eggs in one basket). The performance of her portfolio goes sour, she is upset they didn’t cooperate and in turn, receives a payoff of 0. Meanwhile, Riley’s portfolio performs okay with the bank, just at the market rate, and receives a satisfaction of 2- he is upset Sadie chose to not cooperate.

(1,2) Riley stocks, Sadie bank. Despite Riley’s portfolio performing better than Sadie’s, he is frustrated that Sadie didn’t cooperate, and receives a satisfaction of 1. Sadie has a satisfaction of 3 because her portfolio has no risk involved, but is nevertheless drawn at the sight of the gains in the stock markets.

(stocks,stocks) is a Nash equilibrium equal to 9.

(bank, bank) is also a Nash equilibrium equal to 8.

(stocks,stocks) is payoff dominant as it yields 9. It is considered Pareto superior to all other nash equilibria in the game. (9 > 8/(bank, bank)

The (bank, bank) option yields 8. It is considered the risk dominant strategy because it has the largest basin of attraction (least risk). (Wikipedia Contributors, “Attractor”)

This is because:

For Riley:

Stocks min: 1

Bank min: 2

Bank = safer because worst case = 2 which is better than 1 (stocks)

For Sadie:

Stocks min: 0

Bank min: 2

Bank = safer because worst case = 2 which is better than 0 (stocks)

Behind The Numbers:

For both players, the bank is the risk dominant equilibrium because it provides the highest minimum, whilst stocks are payoff dominant- they have the highest payoff.

We have an equilibrium- the risk dominant one, that is not pareto optimal, and another that is pareto optimal- the payout dominant one. (Shor) Per (Agranov), “the main barrier to reaching this efficient equilibrium is the associated risk.” This risk in this case is the volatility and uncertainty associated with investing in the stock market. (This is not to say investing in the stock market is never successful, look at this graph that shows that in the past timing the market doesn’t matter when investing in the S&P500). Compare this to depositing your money in a commercial bank: central banks are zealous supporters of the large commercial banks (Australia’s big 4) who essentially cannot go bankrupt. This is shown by the TFF program, the Term Funding Facility, introduced in 2020 which gave banks, like the big 4 in Australia, easy money - $188 billion worth of funds are outstanding, that’s 6x the size of the US TARP bailout during the GFC. (188B vs Net Cost) (U.S. Department of the Treasury) It’s safe to say that banks are safe (no pun intended), and this is shown in this matrix.

The Cost of Moving To Pareto Optimal

Sadie Has No Incentive To Change

However, there’s something else interesting with this asymmetric game, as studied by Marina Agranov (Agranov): even if there was communication player to player, the effectiveness is reduced because the players internalise the inequality of the payouts, “leading to significantly fewer proposals to play the efficient outcome compared to the symmetric game.” (Agranov) Sadie has no incentive to change from (4,4) to the pareto-optimal choice (5,4), because 4 and 4 is the same outcome for her, so she won’t make any suggestions. She is indifferent. “Communication is effective when both players have an incentive to choose the Pareto-dominant equilibrium.” (Agranov) (remember, her payout is both 4 because she is more risk averse and hesitant than Riley).

If cheap talk doesn’t bind, (bank, bank) is chosen

(stocks,stocks) is possible with clear communication (with one way communication). (Agranov)

Communication

This asymmetric stag hunt game features unequal payoffs owing to different risk preferences, and with that, two stable equilibria; cooperative payoff dominant or non-cooperative risk dominant (least risky). Cooperation in this game is dependent entirely on expectations of the other player’s choice. Players can either cooperate for a reward (stock market) or defect for a guaranteed reward (bank deposit). Not financial advice.

End

NOT FINANCIAL ADVICE.

References

Agranov, Marina. “Communication in Stag Hunt Games: When Does It Really Help?” Economics Letters, vol. 244, 27 Sept. 2024, p. 111991, www.sciencedirect.com/science/article/pii/S0165176524004750, https://doi.org/10.1016/j.econlet.2024.111991.

“Asymmetric Games Definition - Game Theory Key Term | Fiveable.” Fiveable.me, 2025, fiveable.me/key-terms/game-theory/asymmetric-games. Accessed 6 Feb. 2026.

Mallouk, Peter . “Growth of $2000 Invested Annually in S&P500 from 2001 - 2020.” X (Formerly Twitter), 2026, x.com/PeterMallouk/status/2018725039919780259?s=20. Accessed 6 Feb. 2026.

Reserve Bank of Australia. “Term Funding Facility.” Reserve Bank of Australia, 2021, www.rba.gov.au/mkt-operations/term-funding-facility/.

Scotchmer, Liam. “Polonomic Papers.” Polonomic Papers, 2026, polonomicpapers.com/stag-hunt. Accessed 6 Feb. 2026.

Shor, Mike. “Pareto Coordination Game - Game Theory .net.” Gametheory.net, 2026, www.gametheory.net/dictionary/Games/ParetoCoordination.html. Accessed 6 Feb. 2026.

Shor, Mikhael. “Pareto Optimal - Game Theory .net.” Www.gametheory.net, www.gametheory.net/dictionary/ParetoOptimal.html.

Spaniel, William. Game Theory 101. 2024.

“The Stag Hunt (Game Theory) - IMotions.” IMotions, 4 June 2024, imotions.com/blog/learning/research-fundamentals/the-stag-hunt-game-theory/?srsltid=AfmBOor6lEPqiFbQ9rknr4yC28THZbFbc-0a5NrTdhpYZ253POoiD3I3. Accessed 6 Feb. 2026.

U.S. Department of the Treasury. “Troubled Asset Relief Program (TARP).” U.S. Department of the Treasury, home.treasury.gov/data/troubled-asset-relief-program.

Wikipedia Contributors. “Attractor.” Wikipedia, Wikimedia Foundation, 15 Oct. 2025, en.wikipedia.org/wiki/Attractor#Basins_of_attraction.

---. “Risk Dominance.” Wikipedia, Wikimedia Foundation, 11 Nov. 2018, en.wikipedia.org/wiki/Risk_dominance.