Reading a Government Bond Quote Screen

EXAMPLE 1

Liam Scotchmer

References listed below.

Intro

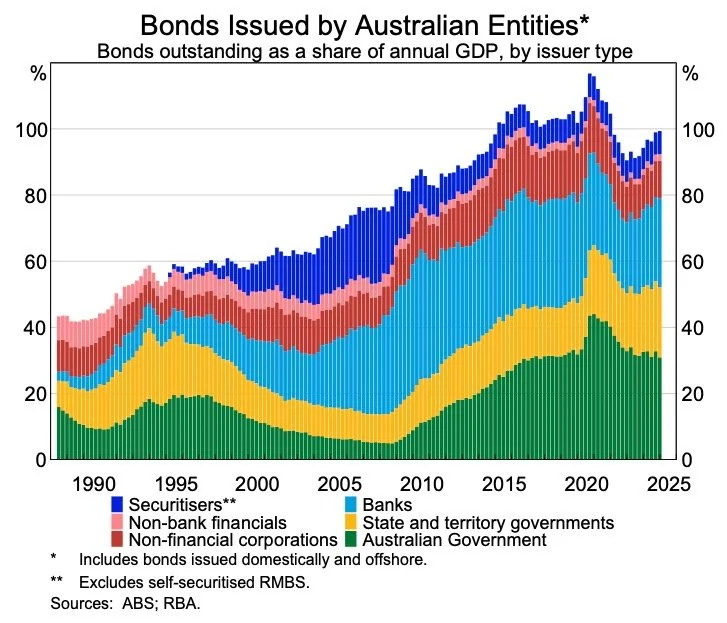

If you read my last article on how fixed rate bonds work, you’ll understand how complex and big they are. According to the Reserve Bank of Australia (2025) bonds issued by Australian entities are now almost the size of the total bank credit in Australia. This figure has grown significantly in only the last few years, supported by banks and government affiliates issuing bonds as shown in the graph below.

3 Minute Read

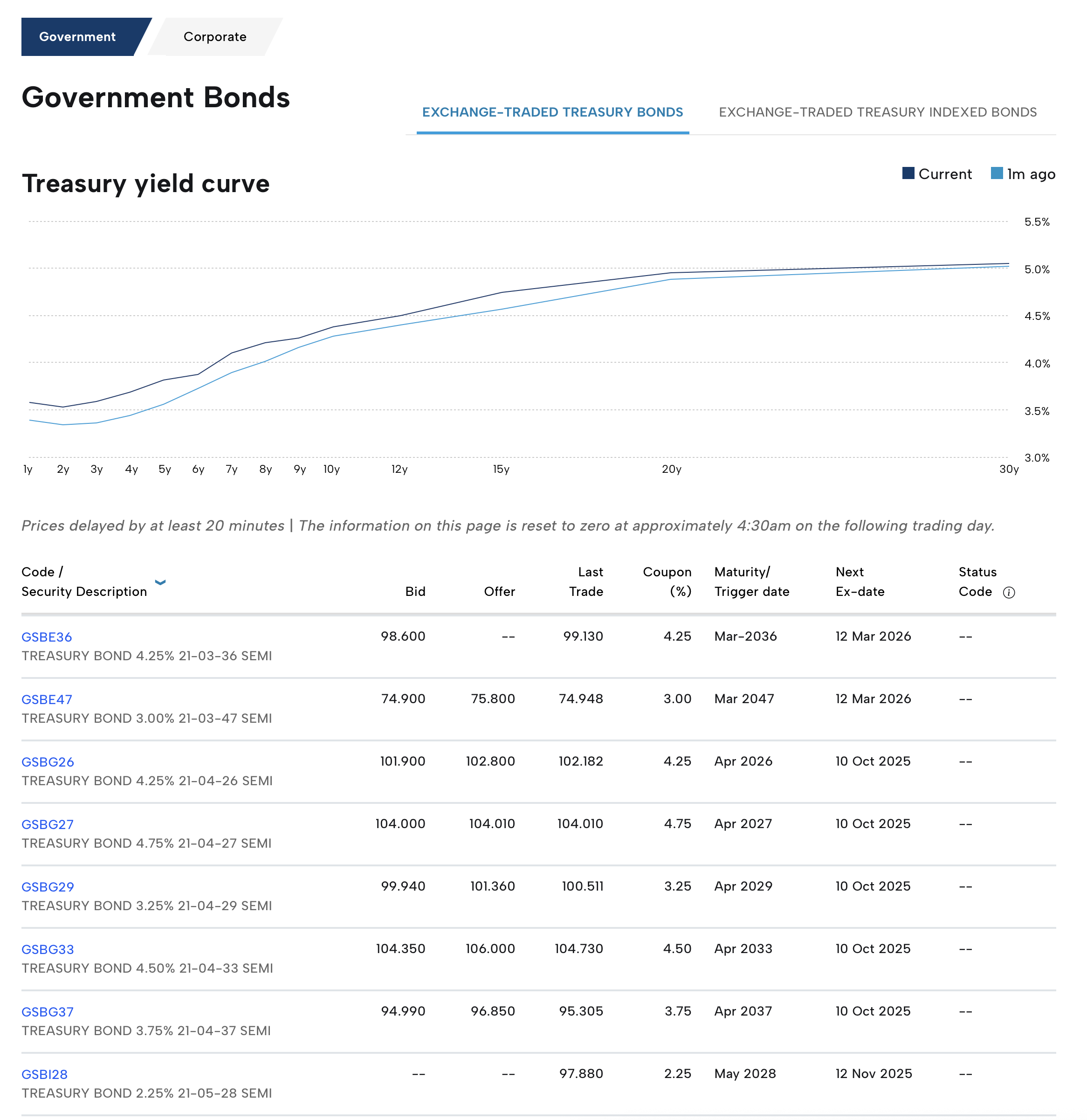

When reading a government bond quote screen, you see the code, bid, offer, last trade price, coupon %, maturity date and next coupon pay date. According to Desjardins Online Brokerage (2025), this is what the bond quote screen means:

Using this as the example: TREASURY BOND 3.00% 21-03-47 SEMI

CODE (TREASURY BOND 4.25% 21-03-36 SEMI)

1. Treasury bonds: For government bonds, it will say a treasury bond (treasury meaning bonds issued by government)

2. 3.00% is the coupon rate (return rate)

3. 21-03-47 is the maturity date

4. SEMI is how often the payments are made (semi annually here)

Bid the highest price BUYERS are willing to pay for this bond (Chen 2024).

Offer (Ask) the lowest price a SELLER is willing to accept for this bond (Chen 2024)

An aside: If you want to buy -> you must offer the offer (ask) price

Last trade the last traded price of this bond

Coupon % the fixed annual or semiannual rate of interest the bond pays

Maturity the date when the face value is owed ($100 in all of these examples).

Next ex-date next coupon payment date. (ChatGPT)

IMPORTANT TO NOTE: Face value for all of these treasury bonds is $100.

How to Read A Bond Quote Screen (Government bonds)

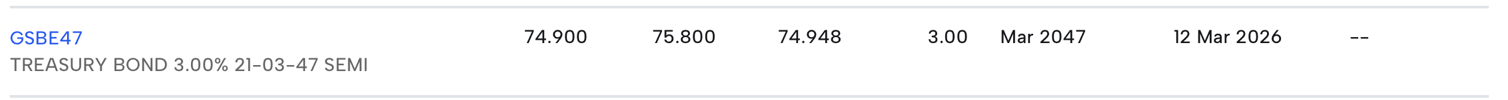

TREASURY BOND 3.00% 21-03-47 SEMI

Last traded price = 74.948

Coupon rate = 3%

Current yield = coupon / market price = 4%

Yield to maturity (YTM) = 4.88% (calculated using ChatGPT)

RBA benchmark yields 10 years = 4.297% (source: RBA)

Face value = $100

This bond is trading at a discount evident by the fact that it is selling below its face value (75<100), and also because the current yield is higher than the coupon rate (when prices go down, it pushes current yield above fixed coupon!).

The reason it is trading at a discount is because its coupon rate (3%) is less than that of similar government bonds at 4.297%. Investors aren’t willing to pay full price for it. Because of this, demand for this bond has fallen, lowering its price, until its YTM aligns with similar bonds (RBA benchmark: 4.297% and YTM = 4.88%)

Additionally, the YTM value is greater than the current yield indicating it is at a discount, and it shows investors will have a capital gain at maturity. (Fernando 2022)

EXAMPLE 2: Compare that to this example with a higher coupon rate

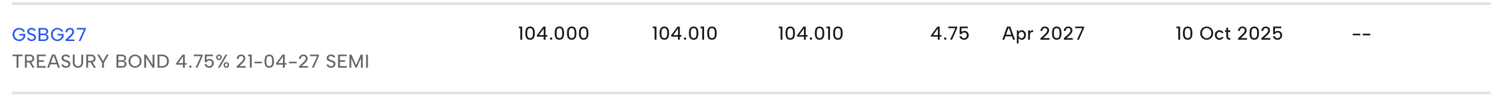

TREASURY BOND 4.75% 21-04-27 SEMI

Last traded price = $104.010

Coupon rate = 4.75%

Current yield = coupon / market price x 100 = 4.57%

Yield to maturity (YTM) = approximately 2.68% (calculated using CHATGPT)

RBA benchmark yields 2 years = 3.448% (source: RBA)

Face value = $100

This bond is trading at a premium (104.01) evident by the fact that its market price is greater than its face value, and also because the coupon rate (4.75%) is higher than the RBA 2 year benchmark of 3.448%.

The reason it is trading at a premium is because its coupon rate (4.75%) is higher than the benchmark yield (3.448%). Therefore, investors want this bond, so demand for this bond has increased, increasing its price, which lowers its yield (YTM) to 2.68%, that is, closer to the RBA benchmark of 3.448%.

Additionally, the YTM (2.68%) value is less than the current yield (4.57%), indicating that the bond is at a premium and investor suffers capital loss at maturity. (Fernando 2022)

These examples are all my own writing - this is not financial advice.

REFERENCES

Bloomenthal, Andrew. “The Role of Market Makers.” Investopedia, 31 Aug. 2021, www.investopedia.com/terms/m/marketmaker.asp.

Chen, James. “Bid and Ask Definition.” Investopedia, 29 Feb. 2024, www.investopedia.com/terms/b/bid-and-ask.asp.

---. “Treasury Bond (T-Bond).” Investopedia, 21 Aug. 2023, www.investopedia.com/terms/t/treasurybond.asp.

Jacobs, David. “Australia’s Bond Market in a Volatile World | Speeches.” Reserve Bank of Australia, 12 June 2025, www.rba.gov.au/speeches/2025/sp-so-2025-06-12.html.

RBA. “Reserve Bank of Australia.” Reserve Bank of Australia, 9 May 2025, www.rba.gov.au.

Fernando, Jason . “Yield to Maturity (YTM).” Investopedia, 2022, www.investopedia.com/terms/y/yieldtomaturity.asp.

“How to Read a Bond Table | Desjardins Online Brokerage.” Disnat.com, 2025, www.disnat.com/en/learning/trading-basics/bond-basics/how-to-read-a-bond-table. Accessed 30 Sept. 2025.

Reserve Bank of Australia. “Statistical Tables.” Reserve Bank of Australia, 2025, www.rba.gov.au/statistics/tables/.