Interbank + Central Bank: How Australia’s Cash Market Really Works

Liam Scotchmer

All references are underlined (& clickable), quoted or listed below.

7 Minute Read

Open Market Operations are conducted to control liquidity and keep interest rates on target by stabilising Exchange Settlement balances (ES). ES balances are used in the Interbank Market and Repo Market: In the Interbank Market, banks make short term unsecured loans bank to bank, with the price of doing so, called the cash rate. In contrast, in the repo market, the overnight repo rate is the rate for borrowing secured loans between banks and the central bank- this rate fluctuates within the policy interest rate corridor (+25bps:0:-10bps). Of the two, the RBA incentivises interbank lending. In the repo market, the RBA works under “Full allotment repurchase auctions” whereby it supplies banks with as many repos as banks demand for their ES balances purposes, however standing facilities are in place to supply banks when there are shortages in their ES balances.

Summary

The RBA conducts open market operations (OMO): the RBA buys collateral from commercial banks in exchange for credit towards their ES balances, a process called a reverse repo (repurchase agreement)

The Australian cash market is made of Exchange Settlement (ES) balances (quantity), price (cash rate), demand (demand from banks for ES balances), and supply (from RBA and bank’s ES balances).

This results in an overnight repo rate, the interest rate on secured overnight loans between banks and the RBA (OMO repo market). However the price of transacting unsecured loans in the interbank market (so between just banks) is at the cash rate which is set by the RBA.

This market between banks is the Interbank Market, and between banks-RBA is the repo market, where any surplus/shortages in ES balances are resolved.

All banks have an ES balance with the RBA.

Secured loan: surplus/shortages are resolved using cash & collateral (GC1 & GC2) whereas an unsecured loan utilises cash only.

Banks are incentivised to resolve shortages/surpluses interbank rather than with the RBA.

RBA supplies all repos demanded, called “Full allotment repurchase auctions.”

Cash rate remains within the policy interest rate corridor because the overnight standing facility rate serves as the ceiling, +25bps (emergency funding from RBA), and ES rate serves as the floor, -10bps (deposit rate with RBA)

OMO repos are priced 5-10bps above cash rate

Again, the overnight repo rate is dependant on supply and demand in the cash market.

Bank process: Interbank market: daily fix in private markets, Wednesday OMOs: primary OMO/weekly reset, SF repos: emergency backup

Bond Purchase Program made up a large portion of RBA’s assets in an attempt to reduce bond yields (5-10yr) for the Australian Government (2020-22)

Term Funding Facility provided low cost borrowing to banks, which has now ceased

Open Market Operations

The RBA conducts open market operations (OMO) by buying collateral from banks (bonds) in exchange for credit towards their ES balances. (Reserve Bank of Australia, 2024c) This cash is for the bank's Exchange settlement (ES) balances.

In October 2021 (Kent, 2025), OMOs were changed from daily to weekly. The process is now completed on Wednesday’s at 9.20am. OMOs are conducted to control liquidity and affect interest rates through rebalancing ES accounts. Wednesday’s are essentially a liquidity reset for commercial banks, during which they can also forecast demand for the following week.

RITS stands for “The Reserve Bank Information and Transfer System” which is Australia’s high value settlement system, used to balance ES accounts for banks. (Reserve Bank of Australia, 2024c) ES balances are commercial bank’s reserves with the RBA.

ES balances are the medium of exchange in both interbank and repo markets. (Reserve Bank of Australia, 2024b)

Think of RITS like the computer program that powers ES balances for the interbank and repo market.

RITS member list here.

To be a bank, you must have an ES account with the RBA. (Reserve Bank of Australia, 2024b) Banks borrow and lend their reserves (ES balances) in response to various price signals. (Kent, 2025)

Exchange Settlement (ES) Balances

One use case scenario of ES accounts is the movement of cash from one bank to another by a customer:

If a customer of bank A owes $100 to a customer of bank B, it isn’t traded directly to the bank, it is exchanged via each bank’s ES balance with the RBA during the day.

However, sometimes banks have to resolve shortages or surpluses in their ES accounts, and it is done so either through the interbank market (unsecured loans) or the repo market (secured loans) overnight. Note: the interbank market is preferred by banks.

Balancing ES Balances

Repo Market: Secured loans aka a repo is the movement of cash & high quality bonds used to resolve ES balances from bank to RBA. There’s collateral involved, usually GC1 and GC2 (optional read at bottom of article). This is why the RBA utilises repos when transacting with banks. (Reserve Bank of Australia, 2021) This is priced at the overnight repo rate.

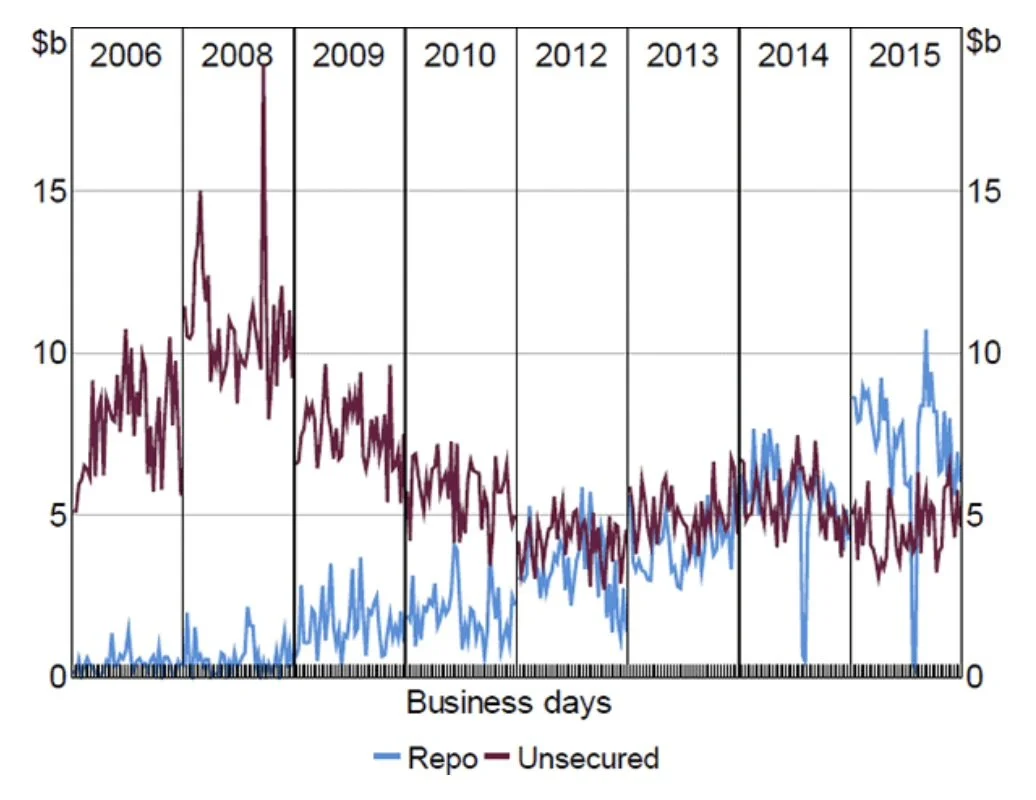

Interbank Market: Unsecured loans is the movement of cash alone, used to resolve ES balances bank to bank. This is priced at the cash rate. (Hing, Kelly and Olivan, n.d.)

Interbank Market & Repo Market

Interbank meaning between banks (Google AI). The Interbank market consists primarily of commercial banks and the RBA (RBA for day-to-day operations and liquidity reasons), but also Investment Banks. (Kaplin, 2024) When a transaction is made interbank, there is the movement of cash alone, no collateral unlike a repo. The RBA incentivises banks to lend interbank first, before using the repo market with the RBA. In the interbank market, only short-term loans are made, typically one day. (Hing, Kelly and Olivan, n.d.)

There is a cost for interbank borrowing, called the cash rate, as explained further on.

A Lens On The Interbank Market:

A Lens On The Repo Market (Bank’s Backup) aka Open Market Operations

Repo, meaning “repurchase agreement” involves the simultaneous movement of cash and securities. This is the Australian repo market, and the RBA only uses repos because there is less risk involved. (Reserve Bank of Australia, 2024c) Repos and reverse repos are different. (Lioudis, 2019) The term to use depends on which side of the transaction you are on, but for the purposes of this article, I won’t explain repos as only reverse repos are completed now (from RBA perspective).

Per Garvin (2018), a reverse repo is the RBA purchasing securities (RBA perspective) (high quality bonds) from commercial banks and agreeing to sell them back in the future. In return, that bank receives credit now for their ES account. This whole process of injecting liquidity into ES balances is called Open Market Operations (OMO), but the bank agreeing to repurchase the security in the future in exchange for cash is called a repo. In the repo market, repos maturities are typically 7 or 28 days in length. (Reserve Bank of Australia, 2024c)

There is a cost for doing a repo, called the overnight repo rate, as explained next.

*There is no cost for intraday repos (Reserve Bank of Australia, 2025b).

Liquidity Transfers - The Interest Rates Involved

Transacting via the Interbank market or the repo market has a cost.

Interbank market: unsecured loans at the cash rate, set by the RBA, influenced by supply/demand for ES balances/repos

Repo market: secured loans at the overnight repo rate (set by RBA for OMOs, currently +10bps above cash rate) (Reserve Bank of Australia, 2025a) It is typically a floating rate. (Reserve Bank of Australia, 2024c)

Ample Reserves With Full Allotment System - A few new changes to OMO

Per (Kent, 2025), recently, a new monetary system for OMOs was implemented. Under the ample reserves with full allotment system, the RBA supplies as many reserves as the banks demand at OMOs (On Wednesdays). It is a similar system to what the European Central Bank and Bank of England utilise. “The system is resilient to structural changes affecting banks’ underlying demand for liquidity.” (Kent, 2025) However, important to note: “it implies a materially larger steady-state balance sheet for the central bank compared with pre-pandemic times.”

You might question why the RBA would do this, however, a summary of Christopher Kent’s words (2025):

Currently, with the transition to ample reserves, the supply of reserves is greater than demand, which reflects the bonds still on the RBA’s books that were purchased during the pandemic (BPP- more on this later). “Our expectation is that reserves will continue to decline gradually for a time in response to the decline in the RBA’s bond holdings. Eventually though, the supply of reserves will approach banks’ underlying demand, and thereafter banks’ participation in OMO should pick up to offset the effect of further declines in the RBA’s bond holdings.” (Kent, 2025)

“[Standing Facilities] are principally used to provide financial institutions with funding to manage their (and their customers’) payments activity.” (Reserve Bank of Australia, 2024a)

This funding provided by the RBA is typically for emergencies, when misforecasts have been made by banks (Sorry Jim, but you’re fired for miscalculating this week’s ES balances 😛), and there are no interbank options.

This funding is done via repos: available at intraday, overnight and/or with open repos.

The following is from this website by the RBA.

Intraday SF repo: intraday meaning occurring within one day: free funding during RITS hours, so carries no interest charge.

Overnight SF repo: Overnight funding “at a pricing rate set 25 basis points above the Reserve Bank’s prevailing cash rate target.” This is a backup for interbank lending.

Open SF repo: SF repo but no maturity date.

Standing Facilities (SF) Important!

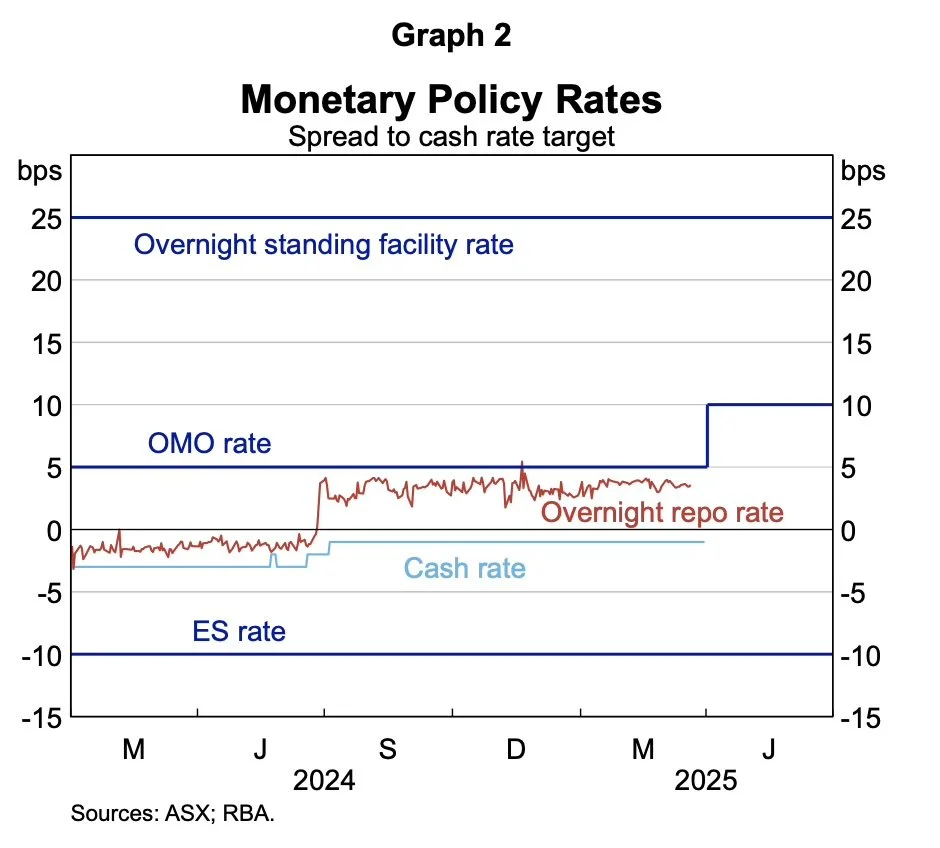

Monetary Policy Rates / Interest Rate Corridor

Now we understand the overnight standing facility rate, the OMO rate, the overnight repo rate and the cash rate. The ES rate is the depositing rate (floor).

The Australian cash market is guided by a variety of monetary policy rates.

The cash rate is set by the Reserve Bank, who aims to have banks target it through the policy interest rate corridor. (Reminder: the cash rate is what banks pay in the interbank market for unsecured lending).

The overnight standing facility rate (+25bps) serves as our ceiling, and is used when banks need urgent overnight funding to resolve shortages in ES balances, and cannot find an option in the interbank market. (Reserve Bank of Australia, 2025d) The ES rate serves as the floor (-10bps), and is used for depositing surplus ES balances if no option is possible in the interbank market. (Reserve Bank of Australia, n.d.)

The corridor:

- No bank will ever offer a bank anything greater than the overnight standing facility (SF) rate because there will be no demand. Other banks would just go to the SF rate.

- No bank will ever offer a bank a deposit rate below the ES rate because no bank would want to deposit at a rate lower than what the RBA is offering.

The OMO rate is the secured loans market, the interest rate at which repos are agreed at. It is set 5-10bps above the cash rate.

The overnight repo rate is the rate of overnight, short term loans, used to resolve shortages in ES balances. It is the interbank market (private market) rate. It is preferred to be utilised before the overnight SF rate (because less borrowing costs of course!)

Example using AI (sorry!)

Bank A forecasts $6B needs but starts day with $2B ES.

1.Check interbank (overnight repo market): Peers offer 3.62% → Borrow $3B here (cheap, preferred).

2.Still short $1B: Bid Wednesday OMO → RBA supplies at 3.65%.

3.Evening shortfall $800M: Interbank dries up → Borrow overnight SF at 3.85% (penalty, last resort).

4.Friday surplus $1.5B: Deposit excess at ES rate 3.50% (floor)

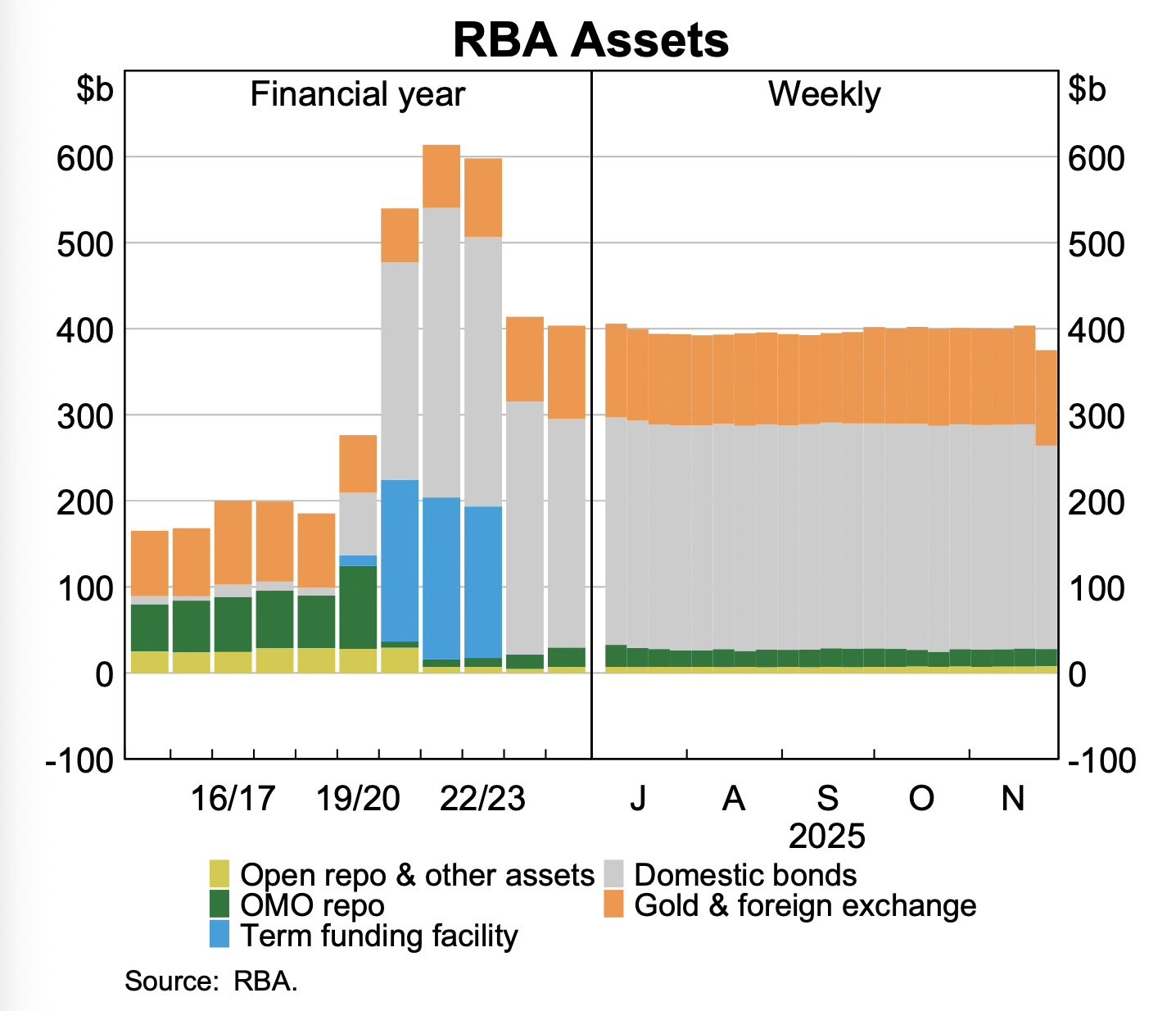

Per Christopher Kent (2025), at present, the supply of reserves is greater than banks’ demand, because the Reserve Bank’s bond purchases (BPP) during COVID significantly increased the supply of reserves. (More on this below). As a result, there is insufficient demand. Over time, as the Reserve Bank’s bond holdings decrease, the supply of reserves will also decline until the supply of reserves approaches banks’ demand for reserves. At this time, banks will offset any further reductions in the supply of reserves by borrowing more from OMO.

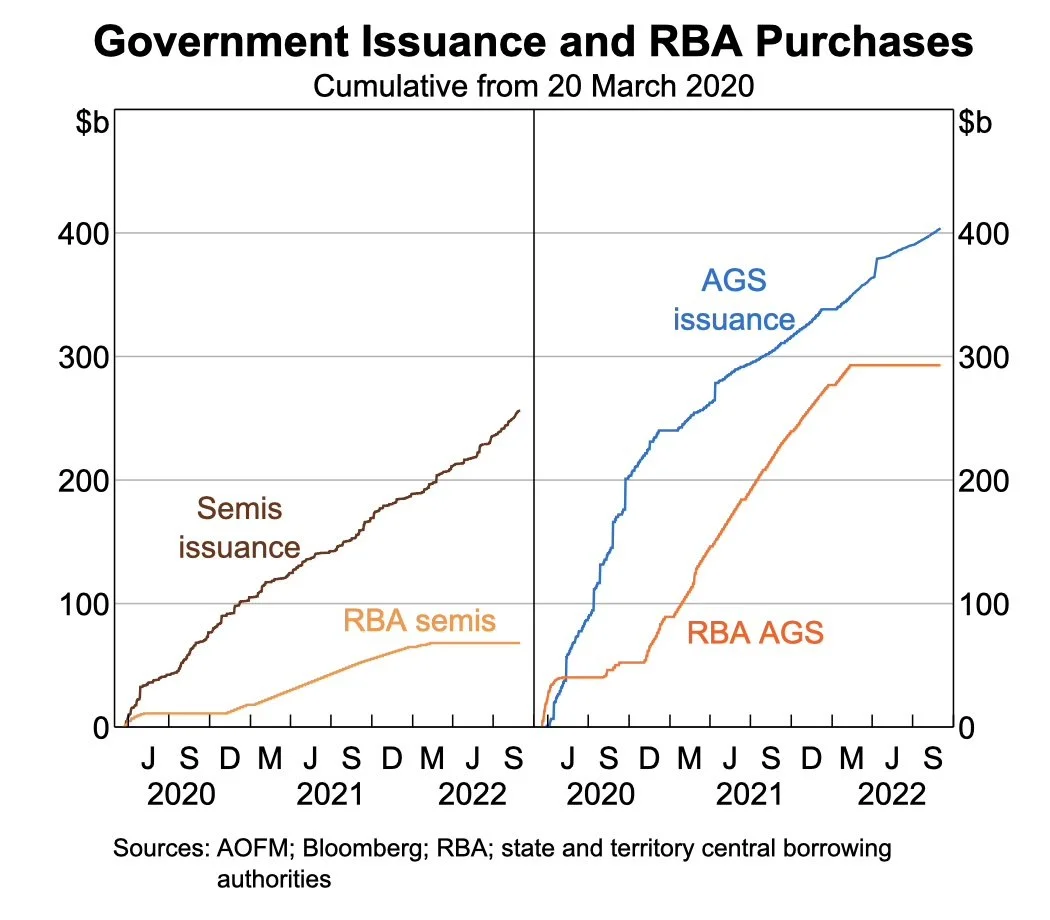

Bond Purchase Program (BPP) - A Covid Program

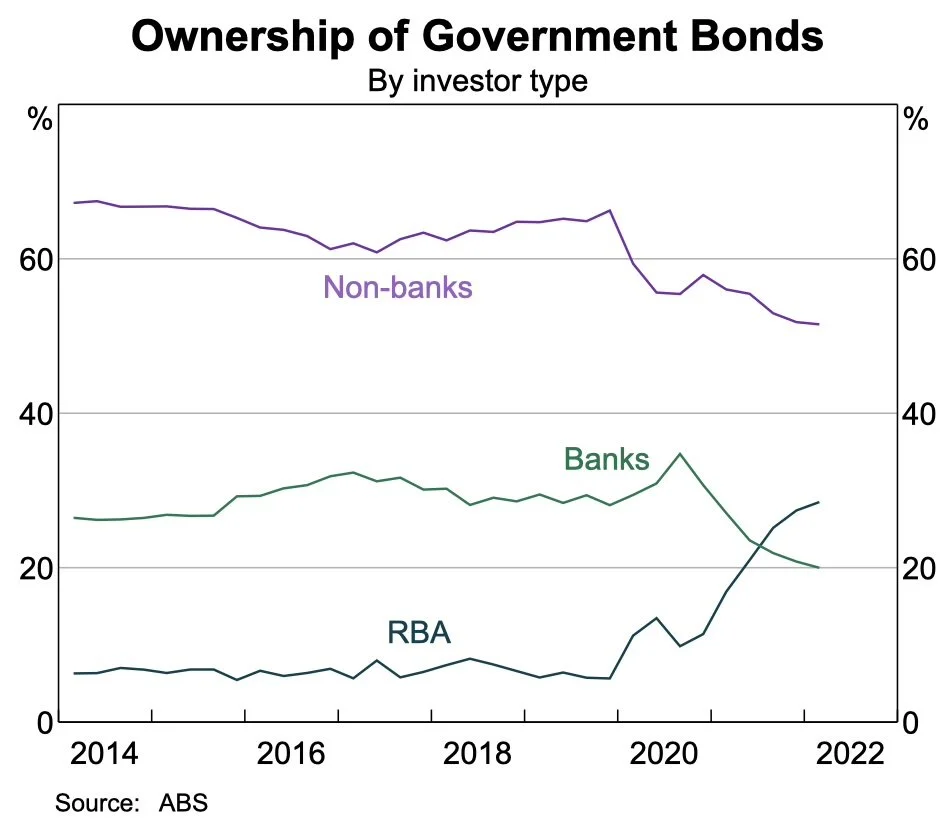

Prior to February 2022, the RBA purchased fixed rate bonds, composed of 80% Australian Government Securities (AGS) and 20% semis in the wake of the pandemic. (Reserve Bank of Australia, n.d.)

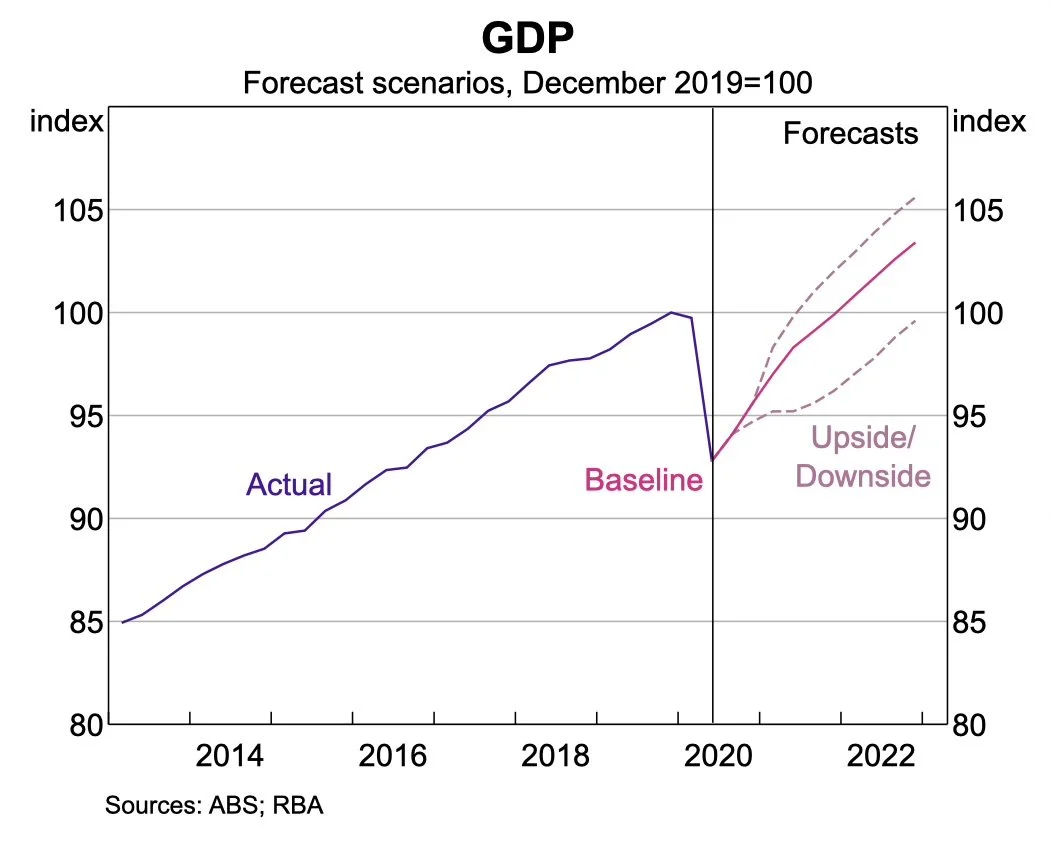

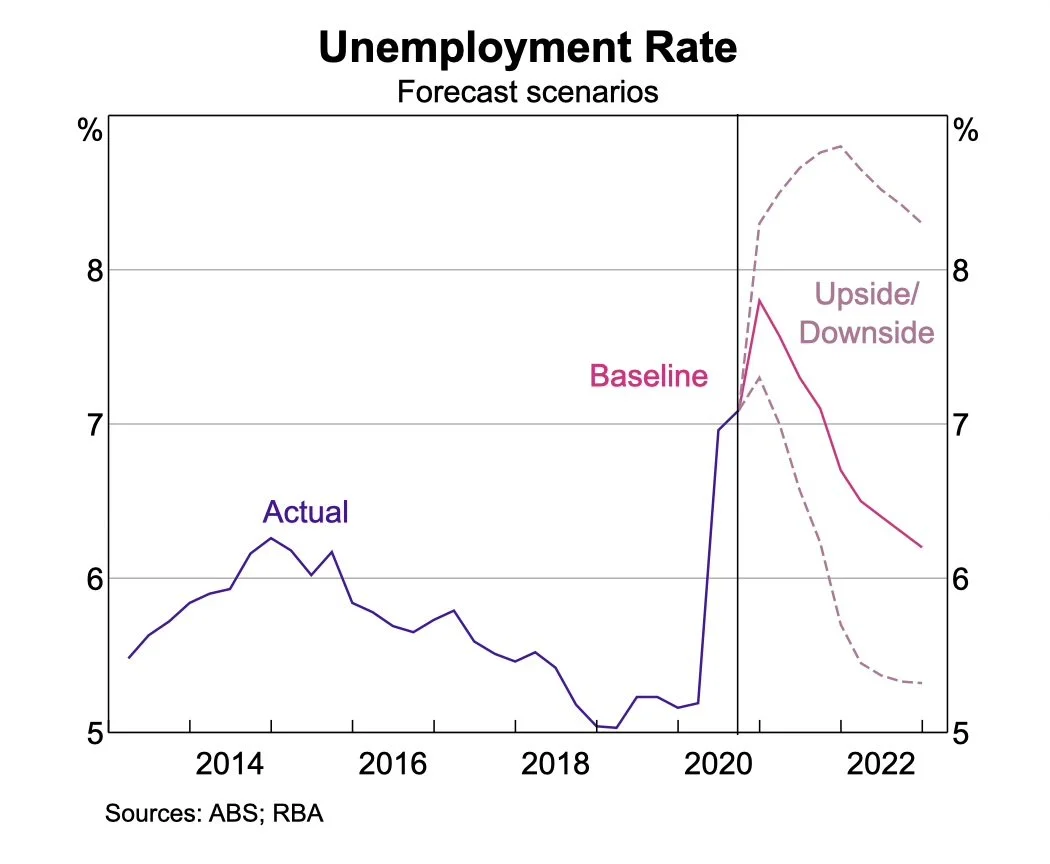

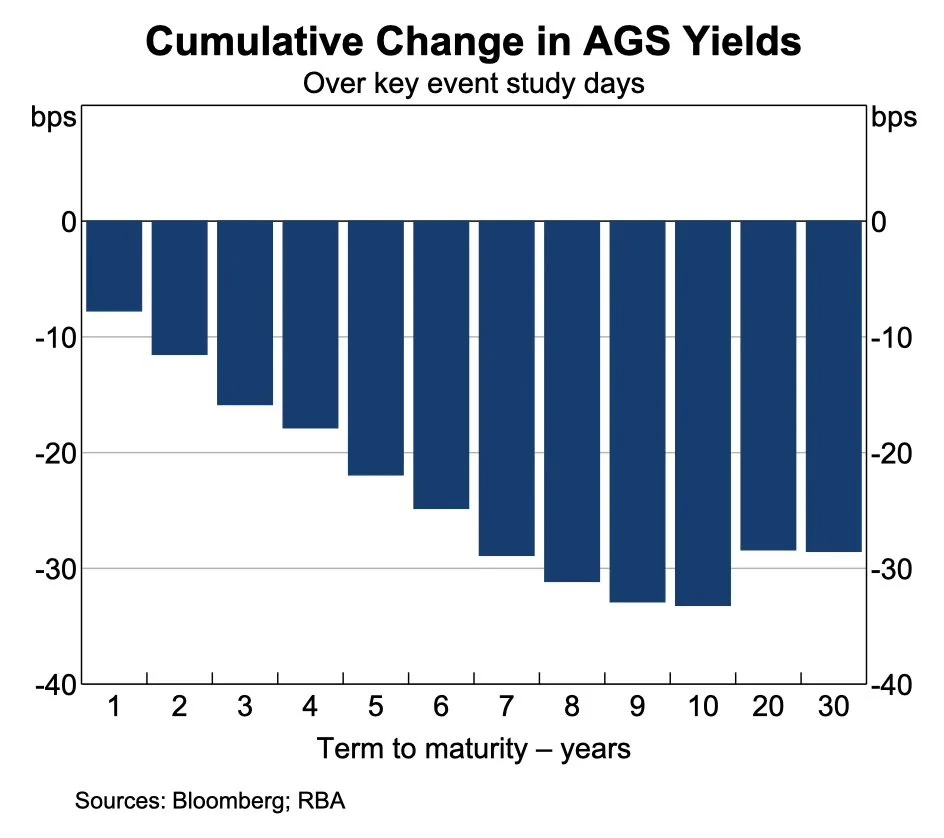

The following is from the RBA (Reserve Bank of Australia, 2022): the bond purchase program (BPP) “[was] part of a second package of monetary policy measures designed to lower the structure of interest rates in Australia.” A total of $281 billion worth of bonds was purchased, roughly $5B/week worth a week, with maturities of 5-10 years. As a result, unemployment was lowered, interest rates across the economy were lowered, bond yields lowered at the 5-10 year part of the yield curve*lower exchange rate (so more exports), and it “supported confidence in the economy”.

*The BPP lowered government bond yields for the Australian government, but the rate was lower than suggested by international studies. (Reserve Bank of Australia, 2022)

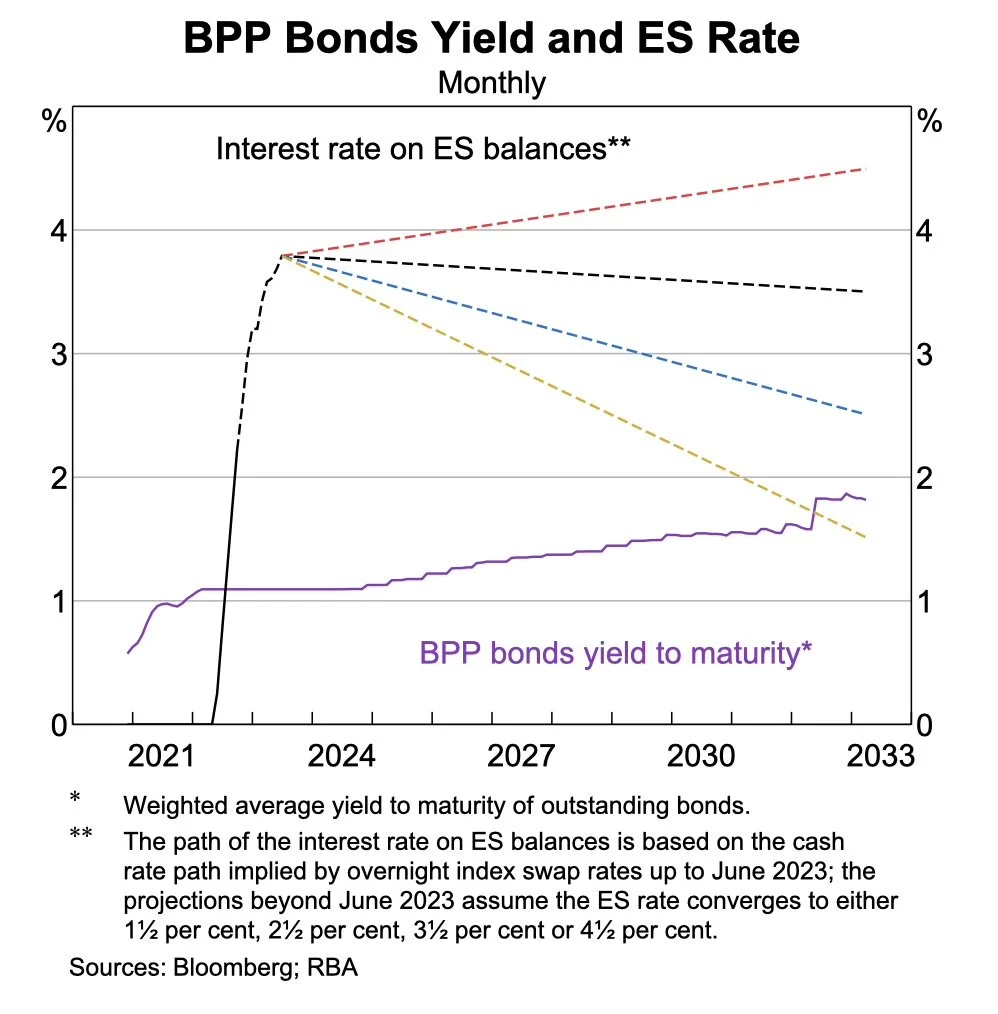

The last bond will mature in 2033. The RBA pays a fixed rate on these bonds, while the interest paid on the ES balances varies with monetary policy settings. “As interest rates increase there is a financial cost to the RBA from this. The ultimate cost will be known only once the last of the purchased bonds matures in 2033.” Furthermore “Under most scenarios, the Bank will not be in a position to pay dividends to the government for a number of years.” (Reserve Bank of Australia, 2022)

This ceased in February of 2022.

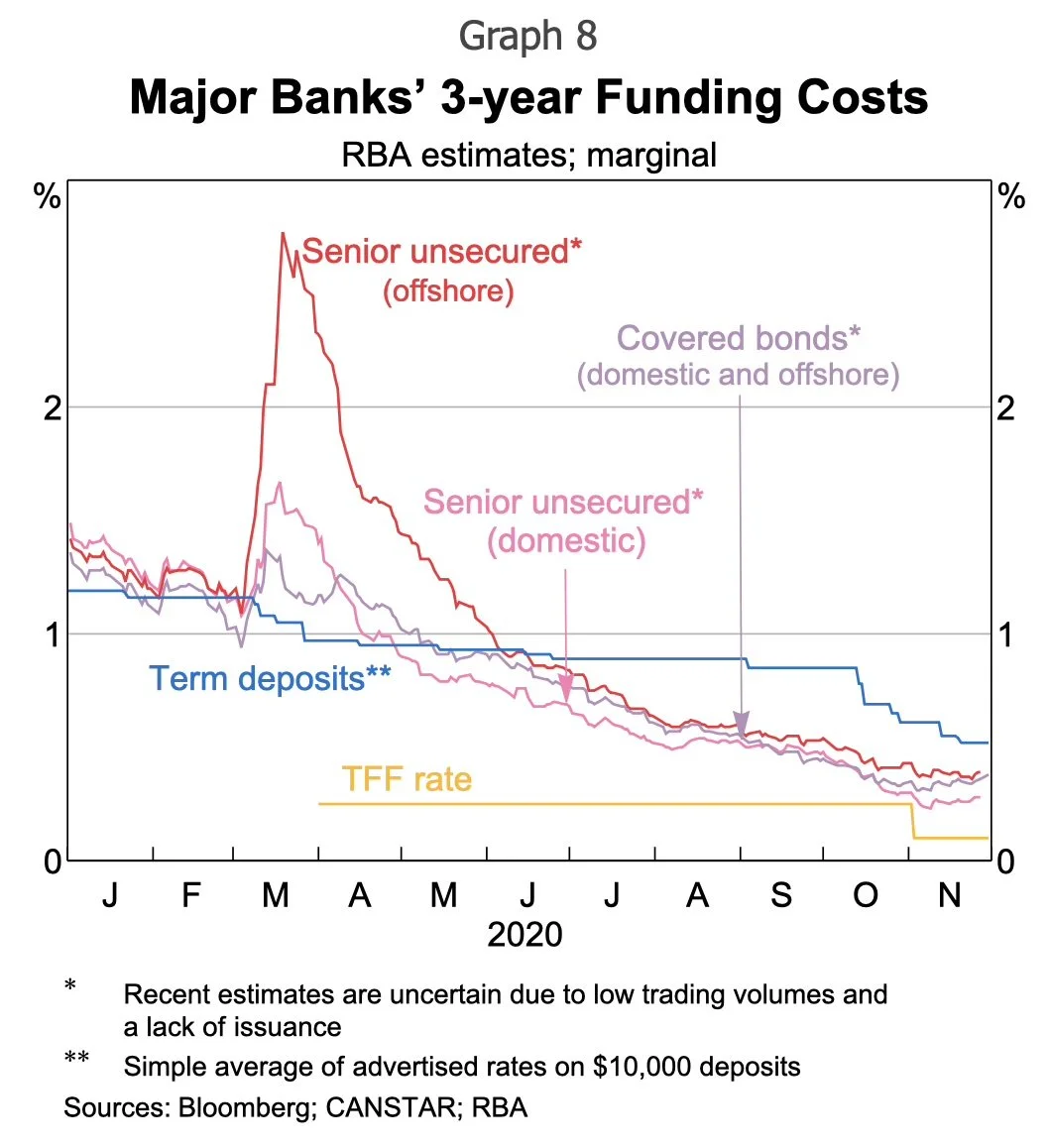

Term Funding Facilities (TFF) - A Covid Program

According to the Reserve Bank of Australia (2024b) the Term Funding Facility (TFF), established in 2020 provided low cost, fixed-rate funding primarily to banks with maturities of 3 years. The rate was at the cash rate target. “Because this interest rate was lower than banks were usually able to access, banks' funding costs declined and banks were able to offer lower interest rates on loans to households and businesses. "

The RBA’s assets can be seen below. TFF (blue) funding rises dramatically: at the same time, OMO repo (green) and open repo (yellow) demand falls (because why “fill up” your ES balance when you can get cheap money from TFF?). Domestic bonds (grey) in RBA’s assets exploded when the RBA purchased a total of $281 billion worth of government bonds, 80/20-AGS/semis. (Reserve Bank of Australia, 2022) Since 2022 (when TFF ceased), OMO repo demand has increased, makes sense!

RBA Assets (Quick analysis)

Assets Used For Collateral (Optional Read)

Firstly, assets used as collateral should meet some criteria, according to ICMA (n.d.):

Collateral should be free of credit risk (no chance that the borrower will default) and free of liquidity risk (asset must be able to be sold easily), which follows HQLA requirements. Additionally, the market value of the collateral should be certain, meaning it has a predictable value, even in the event of a default, or in stressed markets. The closest asset that comes close to meeting this criteria, according to ICMA, are domestically issued government bonds. According to the RBA (2021), 85% of repos are against “General Collateral 1” (GC1). GC1 includes Commonwealth Government Securities (CGS- more written below) and semi-government securities, or “semis” (securities issued by states and territories), all Australian.

The remaining repos in the Australian market are against “General Collateral 2” (GC2), “which includes debt issued by authorised deposit taking institutions (a financial institution licensed by APRA, includes banks), asset-backed securities and supranational, foreign agency and government guaranteeed debt (all AAA-rated securities, according to Google AI), as well as other AAA securities such as covered bonds" (a derivative instrument; value is derived from a package of loans).

First year Economics student here, so any issues, email me at:

Polonomic.papers@gmail.com

Reference list

@lexisnexis. (2025). Interbank market Definition | Legal Glossary | LexisNexis. [online] Available at: https://www.lexisnexis.co.uk/legal/glossary/interbank-market.

Alston, M., Black, S., Jackman, B. and Schwartz, C. (2020). The Term Funding Facility | Bulletin – December Quarter 2020. Bulletin, [online] (December). Available at: https://www.rba.gov.au/publications/bulletin/2020/dec/the-term-funding-facility.html.

AOFM. (n.d.). Treasury Indexed Bonds. [online] Available at: https://www.aofm.gov.au/securities/treasury-indexed-bonds.

Bajaj Finserv (2023). Open Market Operations. [online] www.bajajfinserv.in. Available at: https://www.bajajfinserv.in/open-market-operations-omo.

Bank (2024). Market Operations Resources – Statistics. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/mkt-operations/resources/statistics.html.

Brassil, A. and Nodari, G. (2018). The Interbank Overnight Cash Market | RDP 2018-01: A Density-based Estimator of Core/Periphery Network Structures: Analysing the Australian Interbank Market. Research Discussion Papers, [online] (February). Available at: https://www.rba.gov.au/publications/rdp/2018/2018-01/the-interbank-overnight-cash-market.html.

Chen, J. (2019). Reverse Repurchase Agreement Definition. [online] Investopedia. Available at: https://www.investopedia.com/terms/r/reverserepurchaseagreement.asp.

Chen, J. (2023). Interbank Market Definition. [online] Investopedia. Available at: https://www.investopedia.com/terms/i/interbankmarket.asp.

Christopher, K. (2025). The RBAs Monetary Policy Implementation System – Some Important Updates | Speeches. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/speeches/2025/sp-ag-2025-04-02.html.

Hayes, A. (2024). How the Fed’s Open Market Operations Work. [online] Investopedia. Available at: https://www.investopedia.com/terms/o/openmarketoperations.asp.

Hummel, W.F. (2025). The Australian Monetary System. [online] Wfhummel.net. Available at: http://wfhummel.net/australiansystem.html.

Hing, A., Kelly, G. and Olivan, D. (n.d.). The Cash Market. [online] Available at: https://www.rba.gov.au/publications/bulletin/2016/dec/pdf/rba-bulletin-2016-12-the-cash-market.pdf.

Icmagroup.org. (2026). 12. What is an open repo?» ICMA. [online] Available at: https://www.icmagroup.org/market-practice-and-regulatory-policy/repo-and-collateral-markets/icma-ercc-publications/frequently-asked-questions-on-repo/12-what-is-an-open-repo/.

Kent, C. (2024). The Future System for Monetary Policy Implementation | Speeches. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/speeches/2024/sp-ag-2024-04-02.html.

Kent, C. (2025). The RBA’s Monetary Policy Implementation System -Some Important Updates. [online] Available at: https://www.bis.org/review/r250407b.pdf.

Kenton, W. (2024). The hurdle rate explained. [online] Investopedia. Available at: https://www.investopedia.com/terms/h/hurdlerate.asp.

Majaski, C. (2021). Unsecured vs. secured debts: What’s the difference? [online] Investopedia. Available at: https://www.investopedia.com/ask/answers/110614/what-difference-between-secured-and-unsecured-debts.asp.

Lioudis, N. (2019). Repo vs. Reverse Repo: What’s the Difference? [online] Investopedia. Available at: https://www.investopedia.com/ask/answers/041615/what-difference-between-repurchase-agreement-and-reverse-repurchase-agreement.asp.

Reiff, N. (2024). Repurchase Agreement (Repo) Definition. [online] Investopedia. Available at: https://www.investopedia.com/terms/r/repurchaseagreement.asp.

Reserve Bank of Australia (n.d.). About RITS. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/payments-and-infrastructure/rits/about.html.

Reserve Bank of Australia (2019). Exchange Settlement Account Policy. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/payments-and-infrastructure/esa/.

Reserve Bank of Australia (2022). Review of the Bond Purchase Program. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/monetary-policy/reviews/bond-purchase-program/.

Reserve Bank of Australia (2024a). Domestic Market Operations and Standing Facilities. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/mkt-operations/domestic-market-ops-and-standing-facilities.html.

Reserve Bank of Australia (2024b). How the Reserve Bank Implements Monetary Policy. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/education/resources/explainers/how-rba-implements-monetary-policy.html.

Reserve Bank of Australia (2025a). Cash Rate Target Overview. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/cash-rate-target-overview.html.

Reserve Bank of Australia (n.d.). Government Bond Purchases. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/mkt-operations/government-bond-purchases.html.

Reserve Bank of Australia (2021). The Australian Repo Market | Central Clearing of Repos in Australia: A Consultation Paper | Consultations. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/publications/consultations/201503-central-clearing-of-repos-in-australia/australian-repo-market.html.

Reserve Bank of Australia (2024c). Open Market Operations. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/mkt-operations/resources/tech-notes/open-market-operations.html.

Reserve Bank of Australia (2025b). Standing Facilities. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/mkt-operations/resources/tech-notes/standing-facilities.html.

Reserve Bank of Australia (n.d.). ESA Interest Rates Daily Interest Calculation. [online] Available at: https://www.rba.gov.au/rits/info/pdf/ESA_Interest_Rates.pdf.

Reserve Bank of Australia (2025d). Joint APRA-RBA Statement on Use of the RBAs Overnight Standing Facility | Media Releases. [online] Reserve Bank of Australia. Available at: https://www.rba.gov.au/media-releases/2025/mr-25-11.html.

Reserve Bank of Australia (2025c). The Australian Economy and Financial Markets. [online] RBA. Available at: https://www.rba.gov.au/chart-pack/pdf/chart-pack.pdf?v=2026-02-01-09-36-25.

Team, C. (2024). Interbank Market. [online] Corporate Finance Institute. Available at: https://corporatefinanceinstitute.com/resources/foreign-exchange/interbank-market/.

Transparency.gov.au. (2025). Transparency Portal. [online] Available at: https://www.transparency.gov.au/publications/treasury/reserve-bank-of-australia/reserve-bank-of-australia-annual-report-2023-24/part-2%3A-performance/2.2-operations-in-financial-markets.