Behind Mortgages: What are MBS and CDOs?

Liam Scotchmer

References underlined and listed below.

4 Minute Read

Mortgage Backed Securities

This section is a summary of this article from Investopedia.

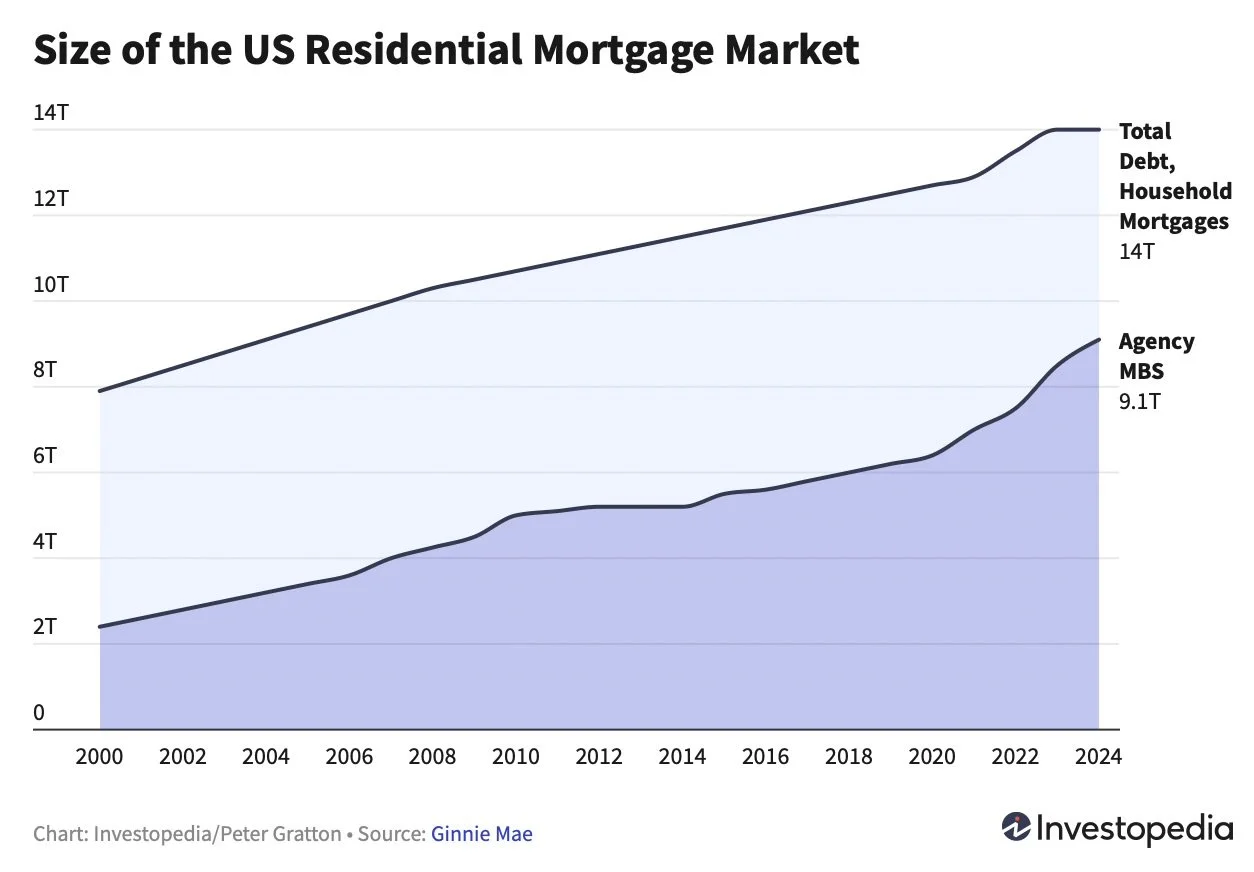

According to Investopedia, the size of the household mortgage market in the US is worth roughly $14 trillion, that’s a lot of debt! And the agency mortgage backed security market is worth just over $9 trillion. This means, when an individual has a mortgage in the US, it’s very likely it will no longer be in the hands of the bank, and instead it is bundled with other mortgages as a mortgage backed security (MBS) and sold to investors!

This is quite the process, done by the hands of a line of “major players” in the secondary mortgage market.

It goes: originator -> aggregator -> securities dealer -> investor.

The process begins with the mortgage originator, aka banks or mortgage brokers. They try to acquire customers.

Once several mortgages have been originated, they are aggregated using an aggregator. The aggregator forms pools of mortgages and make them marketable (a process called securitisation). Company examples include Fannie Mae and Freddie Mac, both government sponsored enterprises (GSEs),(more on agency vs non agency MBS later).

After the MBS has been created by the aggregator, it is sold to the next company: the securities dealer, who sells the MBS onto investors. But, “[securities dealers at these desks do all kinds of creative things with MBS” like… creating CDOs (important for later!)

Now, the last “player” in the line: the investor! Examples include, “foreign governments, pension funds, insurance companies, banks, GSEs, and hedge funds are all big investors in mortgages.”

You may associate the name “mortgage backed security” with the 2008 financial crisis, but today it continues to be a fundamental part of the financial system for various reasons that I will get into briefly. However, today there are increased regulations and audits on MBS. Additionally, most are backed by the US government, thus are considered a safe investment.

However, not all MBS are backed by the US government:

Agency MBS: “issued or guaranteed by government sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac.”

Non-Agency MBS: “Issued by private entities, not backed by government guarantees.” (Higher returns though).

Collateralised Debt Obligations (CDOs)

This section is a summary of this article from Investopedia.

As this is part 1 of a series on the global financial crisis, of course I can’t get away without mentioning collateralised debt obligations (CDOs)! CDOs are called “collateralised” “because the promised repayments of the underlying assets are the collateral that gives the CDOs their value.”

Thus, CDOs are similar to a MBS - they contain mortgages, but they still differ in what goes inside them and how that risk is sliced up.

A CDO is a bundle of mortgages, but also other types of debts including bonds, loans and more. There are a few variations, some with only mortgages, some with only loans.

CDOs are always sliced into classes of investments, called tranches, allowing investors to choose their level of risk and return with each tranche.

Because of these tranches, they can attract a broad scope of investors.

The tranches go:

Senior tranches - hold the least risky debt, pay the lowest coupon (interest) rate, and are paid first.

Mezzanine - in the middle. Paid second.

Junior tranches - hold the most risky debt, pay the highest coupon rate, and are paid last.

Again, note that if the loan defaults, the senior holders are paid first, followed by mezzanine and junior holders.

And important for the next 2 parts on this series of the GFC, a CDO-squared is a CDO that is backed by the tranches of other CDOs, rather then the original loans or bonds! So they are essentially two steps away from the real mortgages.

There are other types of CDOs, such as CLOs, backed by corporate loans, and CBOs, a pool of bonds. There are also synthetic CDOs, which bet on debt, and CRE CDOs which focus on commercial property debt.

Why Do Banks Sell Their Mortgages?

Banks sell their mortgages for three reasons (not an exhaustive list): firstly, liquidity - by moving mortgages off their books, the banks have more cash flowing around available for customers and account holders, this means they can orginate more mortgages! Secondly, to reduce risk (because they have less debt and fewer risky mortgages on their books!) Thirdly, profitability as they make more by “issuing a mortgage, selling it (earning a commission), writing new mortgages, and then selling them” rather than collecting the interest on them for 30+ years.

Why Do Investors Buy Mortgage Backed Securities?

Investors buy MBSs and CDOs because they earn income (regular interest payments!) They are usually higher than government bonds. Additionally, they are considered to be a safe investment as the government backs most of them, meaning if a borrower default’s, the investor does not need to absorb the cost (for agency bonds).

However, like everything, there are risks involved: prepayment risk, where returns can be affected by borrowers refinancing or paying off loans early (if say, market interest rates were to drop). Or interest rate risk: if interest rates rise, fewer people will take out mortgages, causing the housing market to decline. And liquidity risk: non-agency MBS are hard to trade, prices are less transparent, and markets are smaller. However agency MBS are easier to buy and sell because the market is big and active!

End

Whilst Mortgage backed securities (MBS) and collateralised debt obligations (CDO) aren’t as prominent globally as in the US, they played a major role in the global financial crisis, whose consequences snowballed worldwide. It’s important to understand their role in our everyday lives, even today. These methodically engineered and complex financial instruments go through quite a process to create: originators, aggregators, securities dealers, and finally investors are all involved. They keep things liquid, help move risk away from individual banks, while increasing profitability. But as the GFC showed, they can also amplify risk in dangerous ways. They are one of the building blocks behind modern housing markets.

First year Economics student here, so any issues please email me at polonomic.papers@gmail.com

References:

Dye, James. “Research Guides: Fixed Income Securities (Bonds): Collateralized Debt Obligations.” Libguides.nypl.org, libguides.nypl.org/c.php?g=1043575&p=7660195.

Folger, Jean. “Fannie Mae, Freddie Mac and the 2008 Credit Crisis.” Investopedia, 31 Dec. 2021, www.investopedia.com/articles/economics/08/fannie-mae-freddie-mac-credit-crisis.asp.

KAGAN, JULIA. “Mortgage-Backed Security (MBS).” Investopedia, 13 June 2024, www.investopedia.com/terms/m/mbs.asp.

Mansa, Julius. “Shadow Banking System Definition.” Investopedia, 18 Oct. 2024, www.investopedia.com/terms/s/shadow-banking-system.asp.

Nielsen, Barry. “Behind the Scenes of Your Mortgage.” Investopedia, www.investopedia.com/articles/pf/07/secondary_mortgage.asp.

Segal, Troy. “Are All Mortgage Backed Securities (MBS) Also Collateralized Debt Obligations (CDO)?” Investopedia, 2019, www.investopedia.com/ask/answers/040815/are-all-mortgage-backed-securities-mbs-also-collateralized-debt-obligations-cdo.asp.

Singh, Manoj. “The 2008 Financial Crisis Explained.” Investopedia, Investopedia, 25 Aug. 2024, www.investopedia.com/articles/economics/09/financial-crisis-review.asp.

Tardi, Carla. “Collateralized Debt Obligation (CDO).” Investopedia, 1 Oct. 2024, www.investopedia.com/terms/c/cdo.asp.

The Investopedia Team. “Were Collateralized Debt Obligations (CDO) Responsible for the 2008 Financial Crisis?” Investopedia, 2019, www.investopedia.com/ask/answers/032315/were-collateralized-debt-obligations-cdo-responsible-2008-financial-crisis.asp.

U.S. Securities and Exchange Commission. “SEC.gov | HOME.” Sec.gov, 5 Feb. 2017, www.sec.gov.